The Singapore operator of cryptocurrency trading platform Tokenize Xchange is under investigation by the Singapore Police Force and the Monetary Authority of Singapore.

The probe follows the regulator’s rejection of the firm’s digital payment token licence application.

In a joint statement on 1 August 2025, the police and MAS confirmed that AmazingTech and its related entities are being investigated by the Commercial Affairs Department for suspected offences, including fraudulent trading.

Hong Qi Yu, a director at AmazingTech, was charged a day earlier for fraudulent trading. The offence carries a penalty of up to seven years’ imprisonment, a fine, or both.

AmazingTech had been operating Tokenize Xchange under a temporary exemption from licensing under the Payment Services Act 2019, while MAS reviewed its application.

Authorities clarified that such exemptions only apply to entities already engaged in regulated activities when the Act came into force.

MAS rejected AmazingTech’s application on 4 July, ending its exemption.

The firm was then required to halt its payment services, wind down operations, and return all customer funds and digital assets.

On 20 July, Tokenize Xchange announced plans to relocate to Labuan, Malaysia, following the licence rejection.

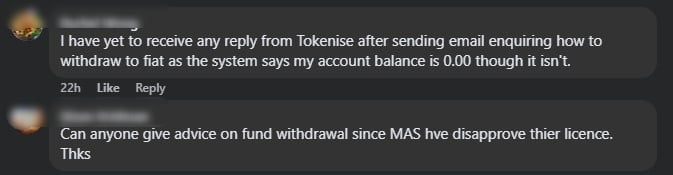

In mid-July, MAS began receiving customer complaints about delayed withdrawals of funds and digital tokens.

MAS instructed AmazingTech to address the issues and ensure orderly return of customer assets.

Subsequent engagements with the company revealed indications that it lacked sufficient assets to meet customer claims.

MAS also suspected the firm had failed to segregate customer funds from its own.

Moreover, MAS uncovered signs that AmazingTech may have misrepresented facts during its application process, particularly regarding asset segregation.

As a result, MAS referred the matter to the Commercial Affairs Department for further investigation.

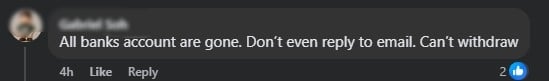

A review of Tokenize Xchange’s official Facebook page shows several user complaints about withdrawal difficulties.

The firm earlier confirmed that it would lay off all 15 Singapore-based staff by 30 September.

Some employees may be offered roles in its international operations, while those remaining in Singapore will continue supporting local users until then.

Tokenize, founded in 2017, operates across Singapore, Malaysia, and Vietnam. It serves both retail and institutional clients.

According to Business Times, Tokenize was among the first three digital asset exchanges to receive full approval from the Securities Commission Malaysia in April 2020.

It is currently Malaysia’s second-largest platform in the sector.

The post Tokenize Xchange under probe in Singapore as MAS rejects licence, director charged appeared first on The Online Citizen.