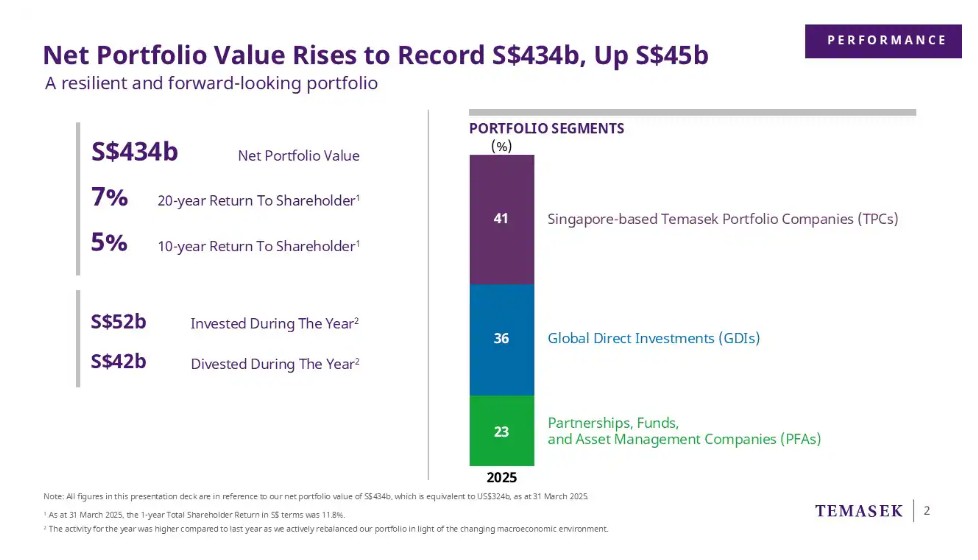

SINGAPORE: Temasek announced on 9 July 2025 that its net portfolio value has reached an all-time high of S$434 billion as of 31 March this year, marking an 11 per cent year-on-year increase.

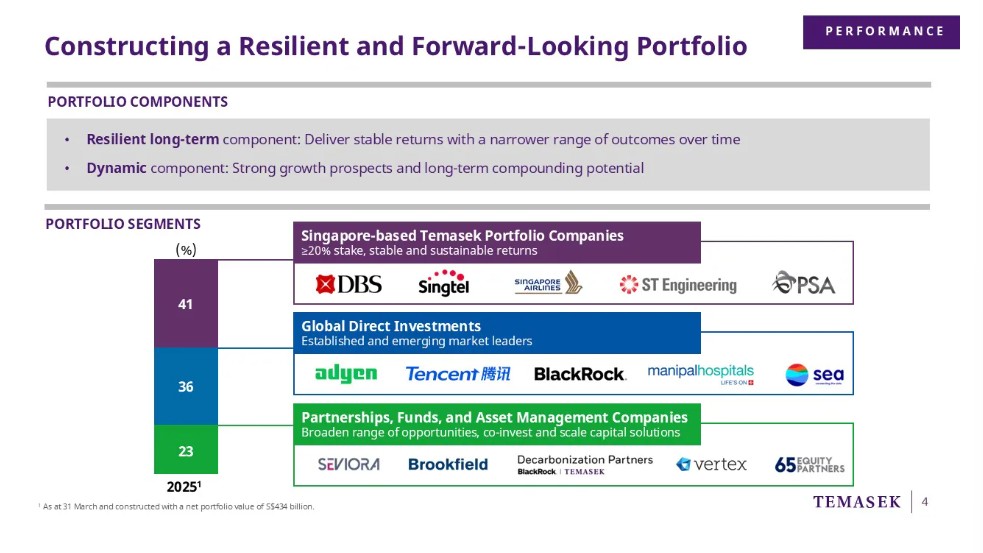

The rise is attributed to strong performance from Singapore-listed companies in its portfolio, alongside direct investments in China, the United States and India.

Temasek is a major shareholder in leading Singapore firms, including DBS and Singapore Airlines.

Unlisted assets push total value to S$469 billion

When factoring in the value of unlisted assets, Temasek’s overall net portfolio would total S$469 billion, according to its annual report.

The report was released amid a backdrop of heightened geopolitical uncertainty, including forthcoming US tariffs on several Asian nations such as Japan, South Korea, Malaysia and Thailand.

The tariffs are set to take effect on 1 August.

In response to such volatility, Temasek stated it has been “actively rebalancing” its holdings to bolster resilience.

It warned that geopolitical tensions remain a key downside risk that could suppress global economic growth in the coming year.

Net investments reversed amid cautious optimism

Temasek invested S$52 billion and divested S$42 billion in the last financial year, resulting in a net investment of S$10 billion.

This marked a shift from the previous year’s net divestment of S$7 billion.

The firm said its strategy targets market leaders with stable cash flows and manageable exposure to trade risks.

Temasek highlighted a preference for companies operating in large domestic markets with robust supply chains and pricing power.

Risks in a multipolar world and AI-driven disruption

Chief executive officer Dilhan Pillay noted the growing uncertainty of a multipolar world order, which he said is being complicated further by the ongoing AI revolution and climate crisis.

“At Temasek, we remain clear-eyed about the risks ahead and continue to navigate the ambiguities that arise in an ever-changing global environment with a pragmatic approach,” he stated.

Singapore-linked firms’ future performance uncertain

When asked about the outlook for Singapore-based listed companies in Temasek’s portfolio, deputy chief executive officer Chia Song Hwee said share prices are difficult to predict.

“What we watch is, are they delivering the targets that they set for themselves?” he said.

He stressed that both the firms and Temasek must remain vigilant, noting that “every day is a battle”.

Temasek is one of three Singaporean entities whose investment returns are partially utilised by the government under the Net Investment Returns Contribution (NIRC) framework.

This framework allows the government to spend up to 50 per cent of long-term expected investment returns from Temasek, sovereign wealth fund GIC, and the Monetary Authority of Singapore.

Temasek’s 20-year annualised return remains at 7 per cent, unchanged from the previous year.

However, its 10-year return fell to 5 per cent, down from 6 per cent in 2024.

“This is because our March 2015 performance, a strong one due to the favourable market conditions that year, has been dropped from the measurement period,” explained Lim Ming Pey, joint head of global strategy.

Strategic divestments and focus sectors for growth

Chief financial officer Png Chin Yee stated that both investments and divestments were spread across various sectors.

She cited the example of a partial divestment from luxury brand Moncler, saying, “We divest when the thesis has played out … when we see that actually we have realised a good profit and want to recycle that into a similar space.”

New investments were targeted at artificial intelligence, digital infrastructure, financial services and broader technology sectors.

Temasek intends to increase its exposure to core-plus infrastructure and AI.

Infrastructure and AI seen as key asset classes

Lim described core-plus infrastructure as an asset class offering resilient, risk-adjusted returns and stable cash flows.

Such investments include digital infrastructure and assets linked to the energy transition, which provide higher yields than traditional infrastructure projects like rail or utilities.

She noted the growing demand for data centres and the need to replace ageing infrastructure as driving forces behind this strategy.

In AI, Temasek is actively exploring opportunities across the value chain—from scaling companies to infrastructure providers and disruptive innovators.

Lim also discussed the expansion of Aranda Principal Strategies, a private credit platform spun off from Temasek’s own credit team.

Aranda now manages a S$10 billion portfolio made up of direct investments and managed funds, and this figure is expected to grow.

US portfolio exposure increases amid innovation strengths

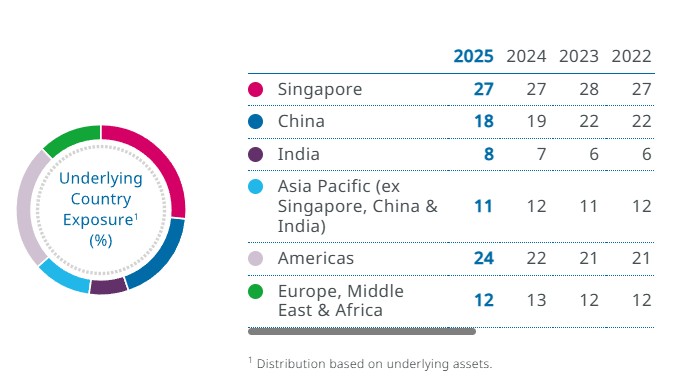

Temasek’s portfolio share in the United States grew from 22 per cent to 24 per cent over the past year.

“The US remains a key investment destination for us,” the firm stated, adding that it maintains diversified global exposure, including in Europe, China and India.

Chief investment officer Rohit Sipahimalani said there continue to be “a lot of attractive opportunities” in the US market.

Lim cited world-leading AI capabilities, deep capital markets and an innovation-driven business culture as strengths that outweigh risks such as immigration policy and trade tariffs.

Europe and China remain key but nuanced markets

Lim said Europe remains attractive, particularly for family-run or engineering-led businesses with global leadership potential.

Temasek is particularly focused on companies in industrials, new energy, financial services and consumer sectors.

In China, economic headwinds remain as a 5 per cent growth target is seen as difficult due to soft consumption and ongoing global tensions.

However, stronger fiscal support from the Chinese government and signs of domestic resilience offer encouragement.

“We continue to believe in the longer-term prospects of China. We see opportunities in the green economy, life sciences and resilient domestic brands,” Lim said.

The post Temasek’s portfolio hits record S$434 billion as it eyes AI and infrastructure amid global tensions appeared first on The Online Citizen.