On Thursday (13 February), the Singapore Department of Statistics (SingStat) released the Key Household Income Trends 2024 paper, revealing that median monthly household income from work in Singapore rose to S$11,297 in 2024, up from S$10,869 in 2023—a 1.4 per cent increase in real terms after adjusting for inflation.

While some welcomed the rise in household income, more netizens expressed concerns.

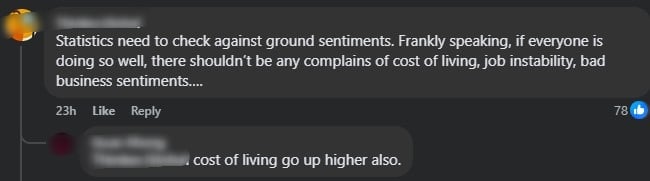

Many pointed out that statistics should be assessed against ground sentiments, as many Singaporeans continue to struggle with the rising cost of living, job instability, and housing affordability.

There were also concerns about whether the data reflected a growing trend of younger Singaporeans staying single and living with their parents, resulting in a higher combined household income.

Some suggested that this highlights concerns among younger Singaporeans who are delaying marriage or choosing to remain single due to financial pressures—an issue underscored by the country’s declining total fertility rate (TFR), which dropped from 1.26 in 2004 to a record low of 0.97 in 2023.

Slower Income Growth Amid Rising Costs

According to SingStat data, median monthly household income from work grew at a slower pace in 2024 compared to the previous year, rising by 1.4 per cent in real terms versus 2.8 per cent in 2023.

When adjusted for household size, the median monthly income per household member increased by 0.8 per cent, from S$3,500 in 2023 to S$3,615 in 2024.

Over the past five years, median household income rose by 0.7 per cent annually in real terms, while per household member, it increased by 1.3 per cent per year.

In 2024, average household employment income per household member grew across all income deciles, ranging from 0.6 per cent to 3.2 per cent. Notably, the lowest and highest income deciles both saw a 3.2 per cent increase.

SingStat noted that some resident employed households in the lowest 10 per cent owned assets like cars, domestic helpers, or private property, or had a household reference person aged 65 and above.

The household reference person could be the oldest member, main income earner, or someone managing household affairs.

From 2019 to 2024, average household income per member in the first nine deciles grew by 0.3 to 1.9 per cent annually in real terms. However, households in the top decile saw a 0.7 per cent annual decline.

Singstat Data: Income Inequality Hits Record Low After Government Transfers

The latest data also indicates government transfers to households increased in 2024, with those in one- and two-room HDB flats receiving the most assistance.

On average, households received S$7,825 per member from government schemes, up from S$6,418 in 2023.

upport measures targeted cost-of-living, retirement, and healthcare needs, with one- and two-room HDB households receiving S$16,805 per member—over twice the overall average.

The Gini coefficient, which measures income inequality, fell to a record low after accounting for government transfers and taxes.

It dropped from 0.371 in 2023 to 0.364 in 2024, reflecting increased government support for lower- and middle-income households.

Netizens Debate the Limitations of Median Household Income as an Indicator of Individual Well-being

Many netizens, commenting on the Facebook pages of state media CNA and The Straits Times, as well as discussion threads on Reddit, expressed skepticism about whether the median monthly household income truly reflects the broader concerns regarding the cost of living in Singapore.

Some netizens argued that statistics should reflect ground sentiments, noting that if incomes were truly rising, complaints about the cost of living, job instability, and weak business conditions would be less prevalent.

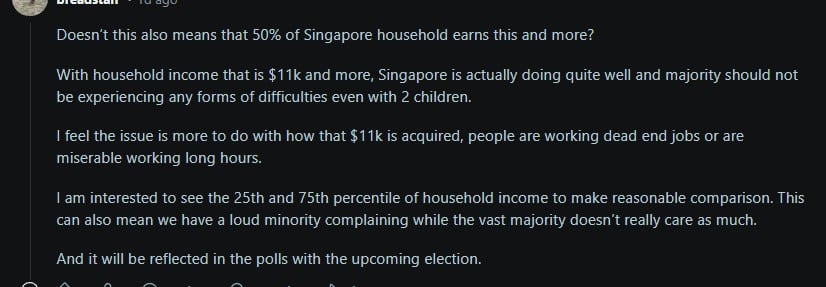

Some expressed interest in comparing income data across different percentiles (25th and 75th) to gain a clearer picture, suggesting that the concerns of a vocal minority might not reflect the majority’s experience, which could influence election outcomes.

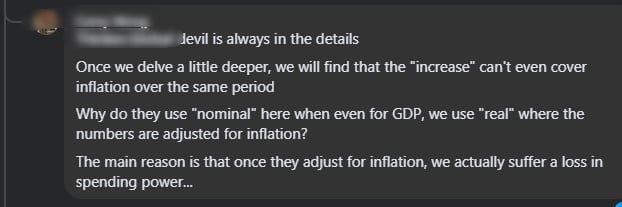

Another FB user pointed out that the reported “increase” in income barely keeps up with inflation, leading to a decline in real spending power. The user criticised the use of “nominal” figures instead of inflation-adjusted “real” figures, suggesting that the data may paint an overly optimistic picture.

‘Majority of Common People Feel the Pain’

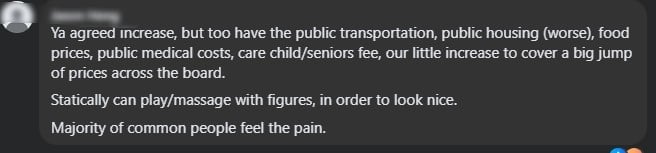

A FB user argued that while household incomes have increased, the rise is overshadowed by surging costs in essential areas like public transportation, housing, food, healthcare, and childcare.

The user felt that the reported figures might have been adjusted to appear more favourable, masking the real financial struggles faced by ordinary Singaporeans.

‘Multi-Generational Households’

Others pointed out that household income may not be a reliable gauge, as multi-generational households with multiple working adults could artificially inflate the figures.

A common scenario cited was families where parents and adult children live together, pooling their incomes to reach the median of S$11,000, but with each individual earning around S$2,600.

According to SingStat data, the average household size in Singapore was 3.09 persons in 2024.

Netizens Suggest Young Adults Struggling to Afford Homes Are Forced to Stay with Parents

Netizens raised concerns that the increase in median household income might be due to young adults living with their parents, either unmarried or married, as they struggle to afford their own homes.

Some pointed out that under-35s either need to be wealthy enough to buy a condo or rely on combined household incomes.

Others highlighted the challenges of waiting for BTO flats, leading many to live with their parents for extended periods.

Some users suggested that SingStat should break down the data into categories such as single-person households, two-generation households, and multi-generation households to better reflect the real situation on the ground.

Netizens Highlight Growing Trend of Elderly Singaporeans Working Past Retirement Age

A comment pointed out that while his grandparents stopped working at 55, parents, now 65, still need to work.

He highlighted that low-income households, particularly those qualifying for the CHAS Blue scheme (monthly household income per person of S$1,500 or below), require more support.

‘Exclusion of Jobless Households Skews Data’

Many agreed that rising household income does not necessarily translate to improved affordability, as the cost of living continues to climb.

A comment argued that the reported median household income does not accurately reflect income inequality.

The user pointed out that while household income may appear high, the income per member remains significantly lower.

Additionally, the exclusion of households without income skews the data, as those who are retrenched and unable to find jobs are not counted, potentially inflating the median figures.

Redditor Critiques Economic Inequality Metrics, Calls for Transparency in Data and Methodology

Notably, a Redditor, claiming to have studied economic inequality, argued that economic inequality encompasses both wealth and income inequality, but Singapore only reports on income, ignoring untaxed wealth income like dividends and interest, which significantly affects the wealthiest.

This, the Redditor said, makes the Gini coefficient unreliable for comparing Singapore to other countries, especially since some nations include wealth-generated income in their calculations.

The Redditor also pointed out that percentage income gains disguise the real inequality, as the wealthy see far larger gains than lower-income individuals, even if the latter experience faster income growth.

The comment further suggested that individual income and work hours, rather than household income, should be the focus, and raised concerns about how inflation and real costs are measured, questioning the transparency of the data and methodology used in official statistics.

The post Singapore’s median household income rises to S$11,297, but netizens cite cost-of-living woes appeared first on The Online Citizen.