Singapore has been ranked the 17th most affordable housing market globally in the latest Demographia International Housing Affordability report, released in May 2025.

The annual report, published by the US-based Centre for Demographics and Policy of Chapman University, evaluates 95 major housing markets across eight nations.

These nations include Australia, Canada, China, Ireland, New Zealand, Singapore, United Kingdom and United States.

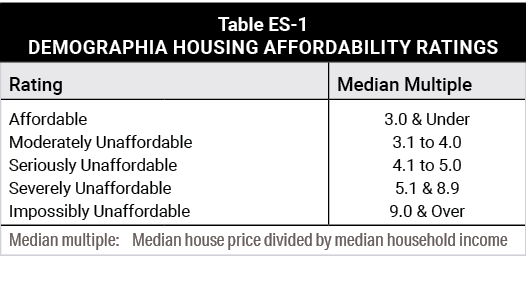

The report uses the median multiple, a price-to-income ratio that divides median house price by median household income, to gauge affordability.

Singapore’s median multiple for resale Housing and Development Board (HDB) flats stood at 4.2.

This places the city-state in the “seriously unaffordable” category under Demographia’s classification.

Despite this, Singapore’s standing at 17th suggests relative affordability compared to many global cities.

The report credited Singapore’s strong position to its extensive public housing policies.

Nearly 90% of Singapore residents own their homes, with approximately 78% living in HDB flats.

Generous subsidies for first-time buyers and a robust framework for low-income housing have contributed to this high ownership rate.

Over the past year, Singapore’s Ministry of National Development and the HDB have introduced new measures to support first-time home buyers.

These measures include increased grants and a lower loan-to-value limit, aimed at easing affordability pressures, the report noted.

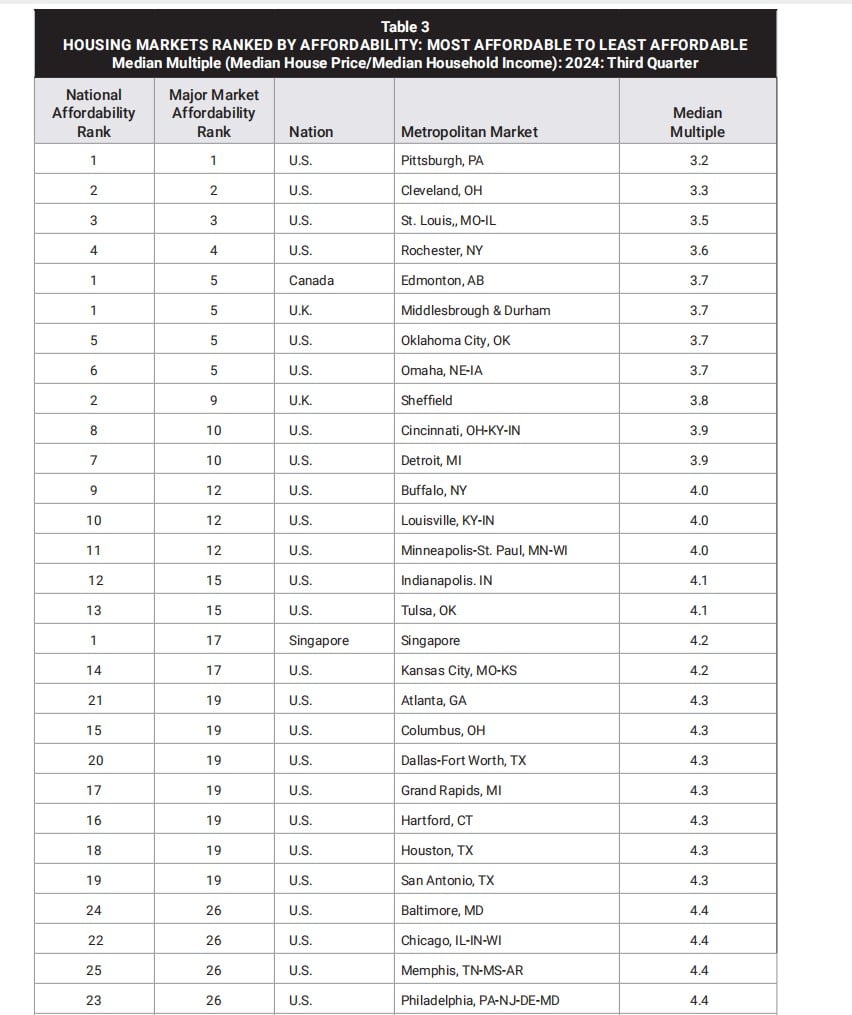

The top ten most affordable housing markets globally were led by Pittsburgh, Cleveland and St. Louis, all in the United States.

Other affordable markets included Rochester, Edmonton, Middlesbrough and Durham, Oklahoma City, Omaha, Sheffield and Cincinnati.

Singapore’s 17th place put it just behind Indianapolis in the US state of Indiana and Tulsa in Oklahoma, and alongside Kansas City.

At the other end of the scale, Hong Kong remained the world’s least affordable market, with a median multiple of 14.4.

Sydney followed at 13.8, while San Jose recorded 12.1 and Vancouver 11.8.

Other cities with high unaffordability included Los Angeles, Adelaide, Honolulu, San Francisco, Melbourne, San Diego, Brisbane and Greater London.

415 HDB resale flats sold for S$1 million in Q2 2025

Locally, HDB resale flat prices continued to show moderate growth.

According to flash estimates from the HDB released on 1 July 2025, resale prices rose by 0.9% quarter-on-quarter in Q2 2025.

This marks the third consecutive quarter of slowing growth, and the smallest quarterly rise since Q2 2020.

Up to 29 June 2025, HDB recorded 6,981 resale transactions.

Despite the slower price increase, million-dollar resale transactions surged to new highs.

According to real estate agency PropNex, 415 HDB flats sold for at least S$1 million in Q2 2025, a 19% rise from 348 units in Q1.

These record figures mean that million-dollar flats made up about 6% of total resale transactions during the quarter.

Breaking down by flat type, Q2’s record included 168 four-room flats, 129 five-room flats, 116 executive flats and two multi-generational units.

All these categories reached record quarterly levels.

PropNex projects that million-dollar transactions could exceed 1,300 units by the end of 2025.

This would surpass the previous record of 1,035 such flats sold in 2024.

Over the first half of this year, more than 100 million-dollar flats were sold each month, bringing the six-month total to an estimated 763 units.

The most expensive HDB resale flat to date remains a S$1.73 million unit at SkyOasis @ Dawson, sold in June 2024.

The post Singapore places 17th in Global Housing Affordability Index appeared first on The Online Citizen.