Singapore’s standing as a nation of savers is weakening, as more workers find themselves living paycheck to paycheck despite being in full-time employment.

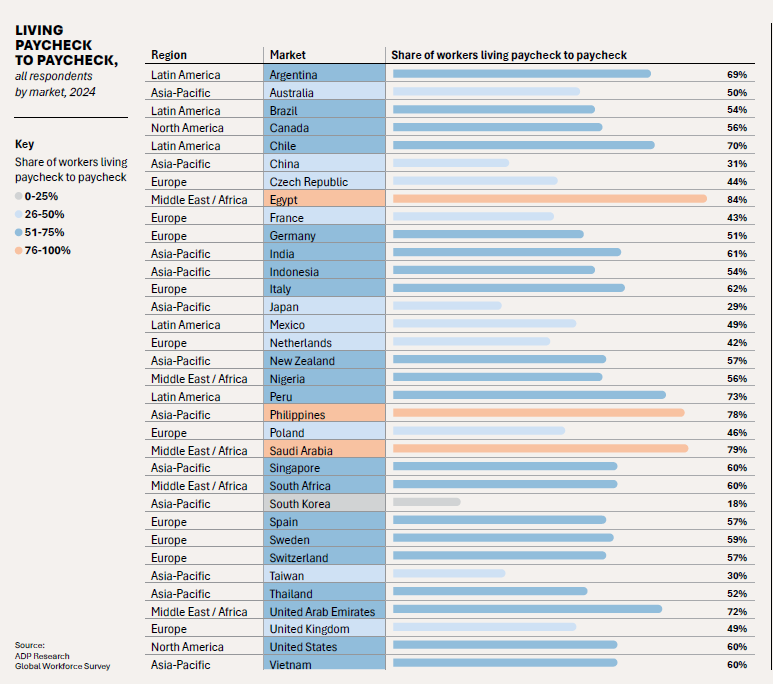

According to ADP’s People at Work 2025: A Global Workforce View, 60% of Singaporean workers reported living paycheck to paycheck in 2024.

This places Singapore above the Asia-Pacific average of 48%, and notably higher than Japan (29%), China (31%), and South Korea (18%).

This is a sharp increase from 2021, when a Forrester Research study pegged the figure for Singapore at 53%.

The ADP survey covered nearly 38,000 workers in 34 markets, including over 1,000 respondents from Singapore. The findings reflect a broad regional trend where even multiple income sources do not guarantee financial resilience.

Multiple jobs fail to close the income gap

Among Singaporeans with two or more jobs, 60% still lived paycheck to paycheck, echoing global findings where holding extra jobs was often insufficient to close the income-expense gap.

While rising costs are a significant contributor to financial strain, the reasons behind Singaporeans holding multiple jobs reveal deeper structural and lifestyle factors.

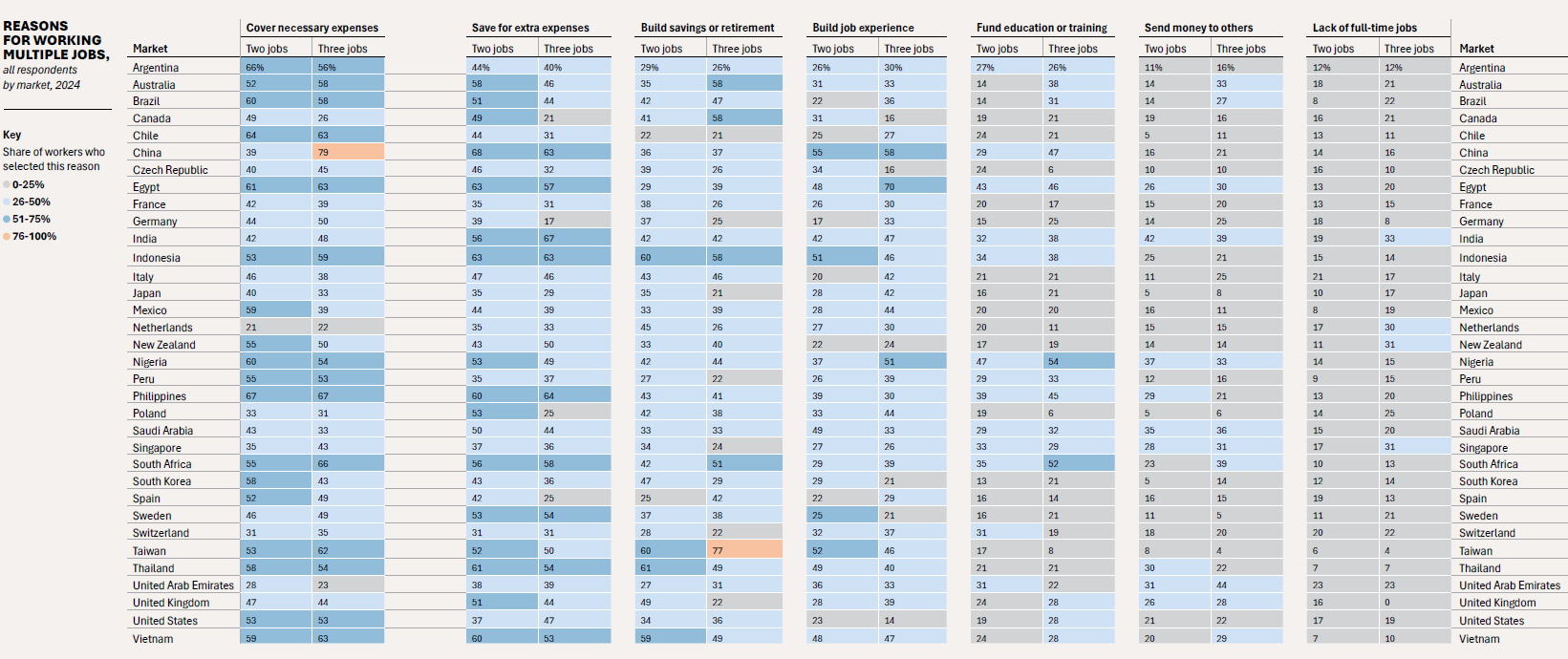

According to ADP’s 2025 data, 35% of Singaporean workers with two jobs and 31% with three jobs cited the lack of full-time employment opportunities as a key reason — suggesting underemployment is a notable driver.

Other motivations include long-term goals and self-investment: 37% of those with two jobs and 36% with three jobs said they work extra to build savings or retirement funds.

Education and training were also cited, with 33% and 29% respectively indicating they take on more work to fund these needs.

Additionally, around one-quarter of respondents mentioned gaining job experience as a reason, showing that side jobs often serve as skill-building opportunities.

Living costs climb to region’s highest

This financial fragility is reinforced by rising living costs.

Singapore topped the Asia-Pacific region in Numbeo’s mid-2025 Cost of Living Index and placed fifth globally.

Year-on-year, the index for Singapore rose 11%, with housing, food, and transport contributing most to the increase.

Public housing costs surged significantly. Resale prices of HDB flats — home to around 80% of residents — increased by 9.6% in 2024, nearly doubling the growth seen in 2023, according to the Housing Development Board.

Real wage trends offer little reprieve. Between 2019 and 2024, Singapore’s real median employment income declined by 0.4% annually, a reversal of the 2.2% growth seen from 2014 to 2019, as reported by Maybank Research.

While 2024 saw a slight rebound, wages are expected to moderate in 2025, especially in sectors affected by tariff shifts.

ADP’s report also highlights that lifestyle-driven financial behaviour is becoming more common.

Lifestyle spending shifts financial priorities

Across Singapore, many respondents cited spending on experiences, fitness, and luxury goods — with little left for savings.

In the words of the report, “More than half of people who have two or more jobs said they’re still living paycheck to paycheck,” illustrating that increasing income streams does not always resolve affordability issues.

Generational changes appear to be driving new spending priorities. Younger Singaporeans are increasingly investing in lifestyle quality and self-care rather than savings.

Fewer people in their 20s to 50s are planning financially for retirement compared to the previous year, according to OCBC’s financial wellness report from late 2024.

This is happening even as Singapore’s financial infrastructure includes mandatory savings schemes like the Central Provident Fund (CPF), which requires employees under 55 to contribute up to 20% of their wages.

However, access to these funds is generally restricted until retirement, and does not assist with short-term liquidity challenges.

Credit systems and short-term liquidity pressures

Singapore also sees high participation in credit systems such as ‘buy now, pay later’ (BNPL) schemes.

According to the Monetary Authority of Singapore, BNPL usage increased nearly fourfold from 2020 to 2021, reaching S$440 million.

The trend is projected to grow, with BNPL expected to account for 6% of Singapore’s e-commerce transactions by 2028.

ADP’s report also noted a regional rise in hybrid and flexible work arrangements, though Singapore had a particularly high share of remote workers at 23% — the highest in the Asia-Pacific.

This may be contributing to a greater sense of freedom in spending, but also a disconnection from long-term financial planning.

Worker stress levels remain high

Worker stress levels also remain high.

Although daily workplace stress in Singapore dropped to 4% in 2024 from 15% the year before, only 26% of workers were classified as “thriving,” up from 15% — still well below the levels seen in other Asia-Pacific economies.

Worryingly, racial and ethnic minority workers in Singapore were the least likely among all surveyed markets to be thriving at work.

Only 6% of minority-identified workers in Singapore described themselves as thriving, compared to 37% of their non-minority peers, suggesting a deeper disparity in perceived well-being.

ADP also found that nearly half of Singaporean workers reported feeling judged for taking advantage of flexible work options, and 47% felt their manager was monitoring their every move — both figures among the highest in the region.

These sentiments are closely associated with reduced productivity and heightened stress, the report noted.

The combination of structural pressures, social shifts, and economic uncertainty points to a redefinition of financial norms in Singapore — where paycheck-to-paycheck living is increasingly becoming a middle-class reality rather than a fringe experience.

The post Paycheck-to-paycheck living hits 60% in Singapore as financial pressures mount appeared first on The Online Citizen.