Netizens have pushed back against Minister for National Development Desmond Lee’s claim that HDB flats remain affordable for Singaporeans, with many arguing that government measures do not reflect reality on the ground.

Speaking on The Usual Place podcast by The Straits Times, Lee outlined the government’s efforts over the last five years to address public housing challenges, particularly in the wake of disruptions caused by the COVID-19 pandemic.

“We haven’t addressed everything, but we’ve addressed many issues that are of more pressing concern to Singaporeans. And at the same time taken these five years not just to tackle the immediate issues, but to look at the medium,” he stated.

The pandemic had severely impacted the supply of Build-To-Order (BTO) flats, delaying completion and tightening the resale market.

HDB had initially planned to complete 20,000 flats in 2020, but less than half were finished due to construction delays. All 92 BTO projects affected by the pandemic were eventually completed earlier this year.

Looking ahead, the number of flats reaching their Minimum Occupation Period (MOP) will increase over the next few years, rising from 8,000 flats in 2025 to 19,500 units in 2028.

Lee said that HDB plans to launch more than 50,000 new flats between 2025 and 2027. With these measures in place, and ongoing cooling measures affecting the resale market, Lee said he expects greater stability in housing prices.

When asked about million-dollar resale transactions, Lee attributed these high prices to the prime locations and newer condition of certain resale flats, although he noted that these million-dollar resale flats have shaped public perception of overall housing affordability.

“So the key is, the resale market headlines of a certain proportion of resale market has captured the imagination of Singaporeans. Bound to be so,” Lee said. “When you have certain headlines, they cause people to have a sense of where the market is.”

“But we continue to assure Singaporeans through ample BTO supply as well as significant injection to stabilize the recent market that housing will remain affordable for Singaporeans,” he continued.

Lee said that Singaporeans should, instead, look at the “hard data,” noting that in 2024, eight in 10 homeowners who collected their BTO keys were able to service their HDB mortgages entirely using CPF, with little to no cash outlay.

“I think that is an indicator of how people have been able to find both BTO and resale flats that are affordable to them,” he stated.

Lee also discussed the Prime, Plus, and Standard flat classification model, which he said was intended to keep flats in attractive locations affordable.

Prime and Plus flats, which are situated near key amenities such as MRT stations, will provide additional subsidies but come with stricter resale conditions, including a 10-year MOP and subsidy clawbacks.

Standard flats will have a shorter five-year MOP and no subsidy recovery requirements. This model, he said, ensures fair access to public housing across different income levels.

“The model ensures that Singapore remains egalitarian and has a good social mix in different parts (of the island), and ensures that our subsidy scheme remains fair in terms of allocation between those who are buying flats in more premium locations versus those in more standard locations,” he said.

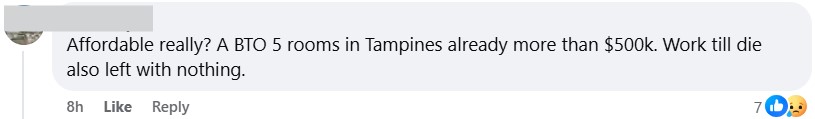

“Affordable really?”

Netizens commenting on his interview, however, expressed a disconnect from the minister’s stance.

They argued that while BTO flats are priced with subsidies, the overall cost of home ownership—including rising interest rates and cost of living—makes affordability a challenge for the average citizen.

One commenter stated that a five-room BTO in Tampines already costs over $500,000, leaving buyers burdened with long-term financial strain.

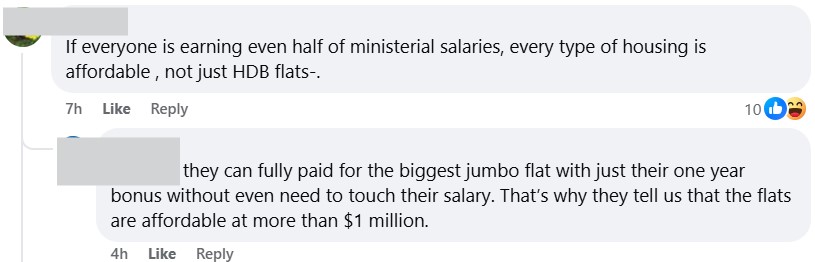

One netizen commented that ministers such as Lee, with their high salaries and yearly bonuses, could afford even the largest jumbo flats without touching their regular income.

This, the netizen claimed, explains why policymakers perceive million-dollar HDB flats as affordable.

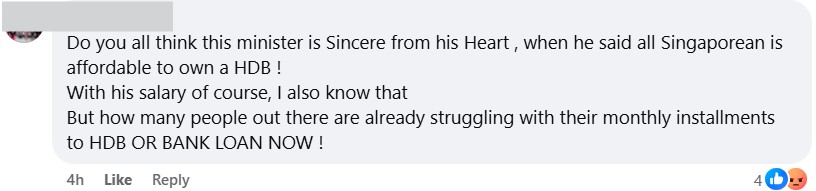

One netizen commented that housing may seem affordable to Lee given his ministerial salary, but many Singaporeans are struggling to keep up with their monthly HDB or bank loan repayments.

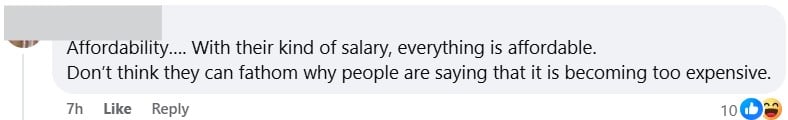

One netizen argued that ministers may not fully understand why many Singaporeans feel housing has become too expensive nowadays.

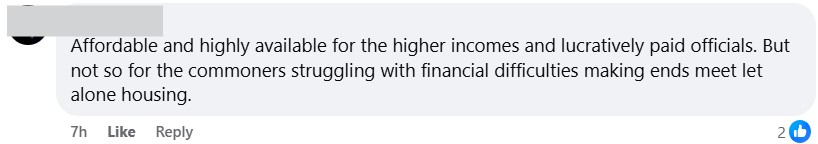

Another netizen argued that housing is only affordable and accessible for higher-income earners and well-paid officials, while ordinary citizens struggling with financial difficulties find it increasingly out of reach.

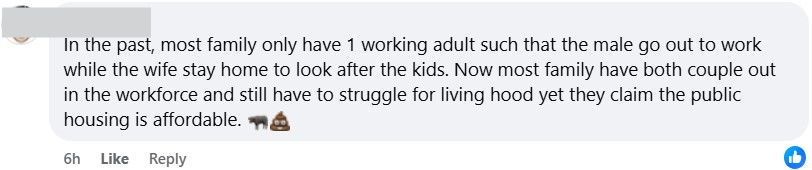

One user pointed out that in the past, a single-income household could afford public housing while the wife stayed home. However, despite more families relying on dual incomes today, many still struggle financially, raising doubts about Lee’s claim that HDB flats remain affordable.

Concerns over financial security

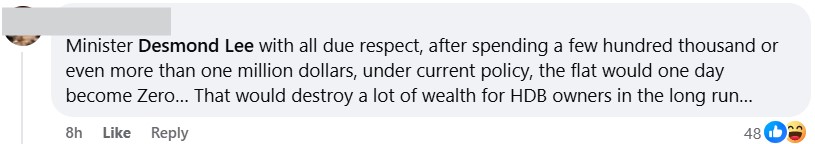

Some netizens raised concerns over the long-term value of HDB flats. One user commented that under current policies, homeowners could see their investments diminish to zero over time, potentially eroding their wealth.

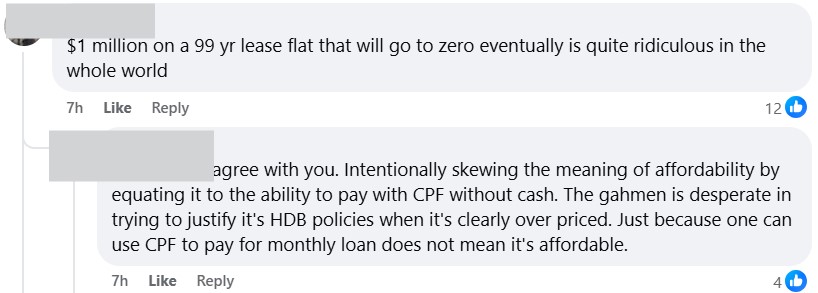

Another netizen questioned the rationale behind paying S$1 million for a property with a 99-year lease that will eventually lose all its value, implying that the current system risks diminishing homeowners’ wealth over time.

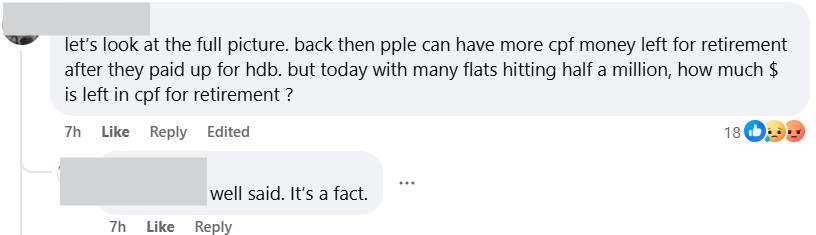

One user argued that homeownership today comes at a greater cost to retirement savings, noting that in the past, homeowners could fully pay off their HDB flats while still retaining sufficient CPF savings for retirement.

The user said that with many flats now costing around half a million dollars, buyers may deplete a significant portion of their CPF, leaving them with less financial security in their later years.

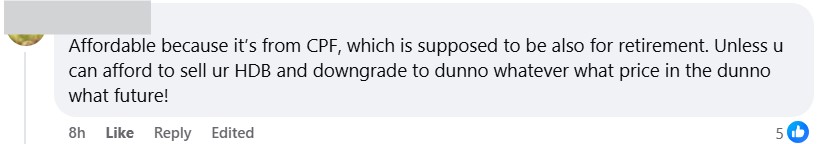

Another netizen questioned the notion of affordability when HDB flats are paid for using CPF savings meant for retirement, suggesting that it could compromise homebuyers’ financial security later in life.

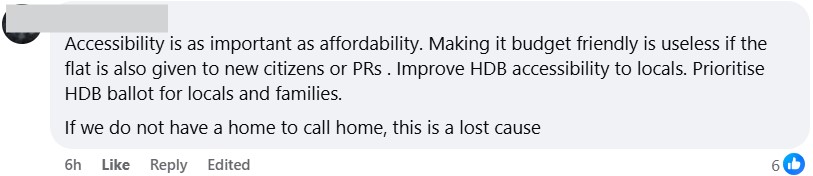

One netizen highlighted that accessibility to HDB flats is just as crucial as affordability, arguing that making flats budget-friendly is meaningless if they are not easily available to Singaporeans.

The user pointed out that new citizens and permanent residents (PRs) might be competing with locals for limited housing supply.

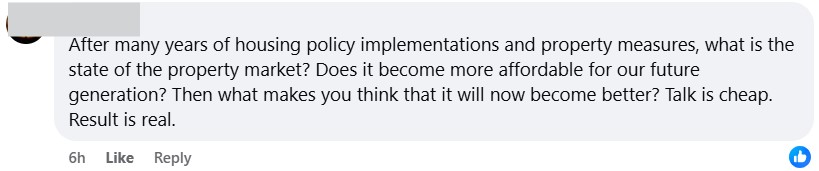

Some netizens questioned the effectiveness of past housing policies, pointing out that despite years of measures, housing has not become more affordable for future generations.

The post Netizens refute Desmond Lee’s claim that HDB flats remain affordable appeared first on The Online Citizen.