Netizens mocked a recent report by The Straits Times for highlighting a drop in Singapore’s inflation rate to 2.4% in 2024, down from the peak of 6.1% in 2022.

Their reactions largely reflected skepticism and frustration, with many arguing that the situation on the ground was far from what was reported. They pointed out that the cost of essential goods and services continued to rise, making it difficult to relate to the claim that inflation had eased.

On Tuesday (11 February), The Straits Times published a report citing data from the Department of Statistics (SingStat) released on 23 January.

The report examined the trend of easing inflation in 2024 following the inflation surge in 2022. Inflation, which hit a 14-year high of 6.1% in 2022, slowed to 4.8% in 2023 before dropping further to 2.4% in 2024.

The article highlighted this as a significant improvement, noting that inflation in recent years had far exceeded the historical average of 1.8% from 1981 to 2021.

The decline in inflation was attributed to lower prices in several key sectors, including cars, certain food items, clothing, and footwear, which helped ease overall price pressures.

Inflation Slows, But Prices Continue to Rise Across All Income Groups

Despite the general decline in inflation, households in all income groups still faced price increases, albeit at a slower pace than before.

The lowest-income households experienced an increase of 2.7%, while middle-income households saw a 2.5% rise, and high-income earners faced a 2.1% increase in inflation.

SingStat’s data showed that excluding rent for owner-occupied accommodation, which is not applicable to homeowners, inflation in 2024 stood at 2.6% for the lowest-income households, 2.4% for middle-income households, and 2% for top earners.

“People who own their homes do not pay rent, so the CPI figure that excludes this outlay is more representative of average households,” the article noted.

The primary contributors to inflation in 2024 included accommodation, food, hospital and outpatient services, holiday expenses, and transportation costs such as bus and train fares.

These categories saw price increases that contributed to inflationary pressures.

However, the decline in prices for cars and motorcycles, as well as airfares, helped offset these pressures, the report claims.

Notably, cheaper vehicles and transport services had a more significant impact on top earners, who allocate a larger portion of their spending to cars. For this group, the reduced cost of vehicles helped reduce their overall inflation experience more than for other income groups.

In contrast, lower-income households were disproportionately affected by higher transportation costs, particularly bus and train fares, which contributed to a relatively higher inflation rate for this group.

This highlights the varying impact of inflation across different income levels, with wealthier households benefiting more from reduced transport costs, while lower-income groups continue to bear the brunt of increases in public transportation and other essential services.

Netizens question inflation data, cite rising costs amid election year

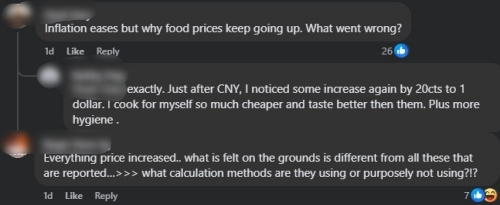

Observing comments on ST‘s Facebook page and a discussion thread on Reddit, it is evident that many have challenged the data, arguing that they do not feel the impact of the reported “easing inflation” in their daily lives.

Many lamented that prices of essential goods, especially food, continue to rise, making it difficult to relate to the official statistics.

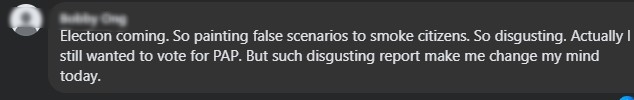

Some sarcastically labelled the article as “propaganda,” questioning whether the state media was attempting to paint a positive picture to pacify citizens ahead of the election year.

‘Cai png still very expensive’

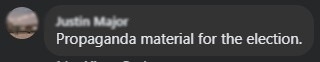

On Reddit, a user humorously noted that while inflation was reportedly easing, ‘cai png’ (economic rice) was still becoming more expensive, implying that some items were not seeing the same benefits of lower inflation.

Another user pointed out that while the title of the report suggested lower prices, the reality might be that some items are still rising in cost, while others may be getting cheaper.

GST hike seen as major contributor to rising costs

A netizen raised a valid point, stating that the GST increase was a major factor in driving up costs. The comment pointed out that after the price adjustments following last year’s final GST hike, it’s expected for inflation to ease from an already high point, but the damage has already been done.

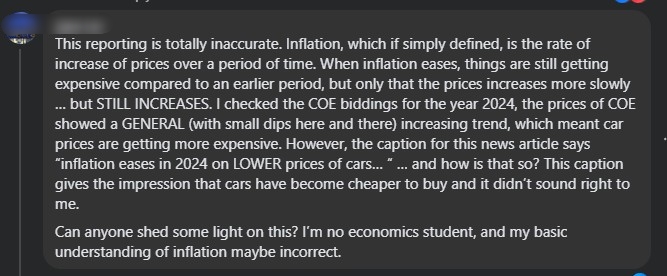

One netizen pointed out that inflation refers to the rate at which prices increase over time. Even if inflation slows down, prices are still rising—just at a slower pace—rather than actually decreasing.

The user said he checked Certificate of Entitlement (COE) prices in 2024 and observed a general increasing trend despite some fluctuations, which suggests that car prices should have remained high or increased rather than fallen.

Meanwhile, some defended the report, pointing out that it did not make a sweeping claim that inflation had decreased across all items. They noted that while inflation persisted for certain goods and services, prices had indeed fallen in specific categories.

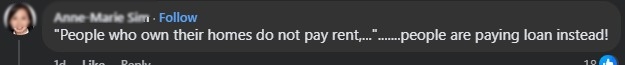

Homeowners do not pay rent, but shoulder housing loan burden

Another comment pointed out that while homeowners do not pay rent, they are still servicing housing loans, which reduces their disposable income. This, in turn, affects their ability to spend, making the reported inflation figures feel less reflective of their financial reality.

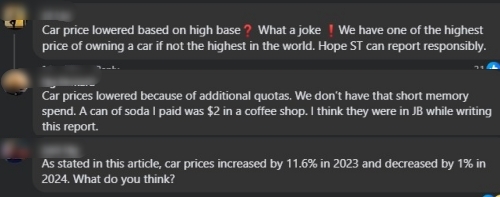

Lower car prices attributed to increased COE quotas

Netizens criticised the report, questioning the claim that car prices had decreased and calling it misleading.

Many pointed out that any reduction in car prices was relative to an already high base, given Singapore’s status as one of the most expensive places in the world to own a car.

Some highlighted that the lower car prices were due to an increase in COE quotas, rather than a genuine long-term price decline.

There are also comments called out that CPI for cars in 2023 was 11.6, but merely dropped to -1% in 2024.