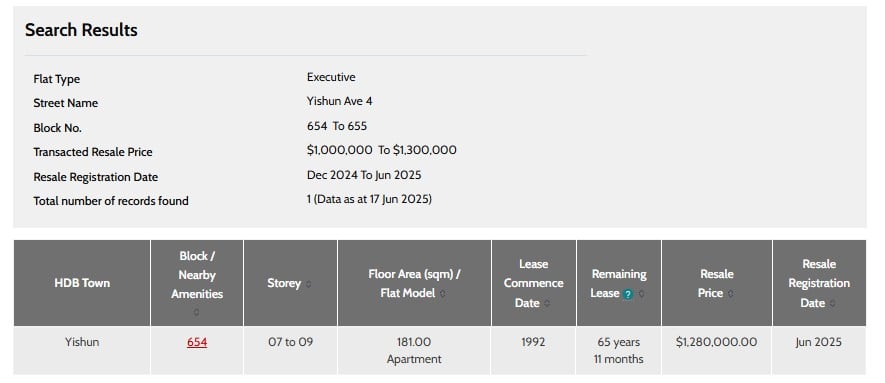

SINGAPORE: A jumbo executive flat in Yishun has become the town’s most expensive resale HDB unit to date, fetching S$1.28 million in a recent transaction.

Located at Block 654 along Yishun Avenue 4, within Nee Soon Central View, the flat spans approximately 1,948 square feet.

This translates to a price of S$657 per square foot, according to property portal 99.co.

The unit, situated between the seventh and ninth floors, has a remaining lease of 65 years and 11 months.

Source: HDB’s Check Resale Flat Prices

Despite not being located near an MRT station, the property enjoys proximity to family-friendly amenities, according to 99.co.

These include Yishun Park Hawker Centre, Wisteria Mall, several childcare centres, kindergartens, and primary schools.

Its large floor area and low-density environment make it particularly attractive to multi-generational families.

The price gap between Nee Soon Central View and other flats in Yishun has been widening. In 2020, this area’s units were priced about 20.53% higher than average. By 2025, that difference had grown to 27.61%.

This is only the second time a flat in Yishun has crossed the S$1.2 million mark.

The previous record was set in March 2024 by a multi-generational flat, which sold for S$1.2 million.

Minister: high-value resale flats still a minority

While Yishun’s new record made headlines, it is dwarfed by other top-end HDB sales in central regions.

For instance, a 5-room loft at SkyTerrace @ Dawson in Queenstown was sold for S$1,658,888 in June 2025.

However, the highest remains a S$1.73 million unit at SkyOasis @ Dawson, sold in June 2024.

At a media briefing on 20 August 2024, then-National Development Minister Desmond Lee addressed growing public concern about rising resale flat prices.

He noted that flats transacting at such high prices make up only 0.5 per cent of all four-room or smaller flat sales over the past two years.

“These flats are usually in central locations, high floors, and close to MRT stations and amenities,” Lee said.

Lee warned that such headline-grabbing prices could distort public expectations.

“Flat sellers who are reading such news raise their expectations, while flat buyers become anxious to secure flats before prices get higher,” he said during the 5 March 2025 Parliamentary budget debate.

“If we are not careful, such market dynamics can cause the resale market to run out of line with economic fundamentals and cause a bubble.”

2024 saw record HDB resale activity and price growth

According to HDB data released on 24 January, resale flat prices rose by 9.7% in 2024.

This increase follows a 4.9% rise in 2023 and a 10.4% surge in 2022.

Despite strong demand, resale transactions in the last quarter of 2024 fell by 21.1%, though the total number of units sold for the year reached 28,986.

A record 1,035 resale flats crossed the million-dollar mark in 2024, indicating strong interest in well-located, high-specification units.

The post Jumbo HDB unit in Yishun sold for S$1.28 million, setting new town resale price record appeared first on The Online Citizen.