Lim Chow Kiat, Chief Executive Officer of Singapore’s sovereign wealth fund GIC, has declined to comment on reports that GIC owns more than 540,000 acres of land in Michigan’s Upper Peninsula.

This holding represents over five per cent of all land in the Upper Peninsula and makes GIC the largest known foreign agricultural landowner in the US state.

GIC CEO offers no clarity on Michigan land ownership

On 25 July, GIC released its 2024/25 annual report. During a media briefing, Singapore’s state-owned The Straits Times asked Lim about concerns raised in Michigan regarding GIC’s significant ownership of forested land.

In response, Lim cited GIC’s longstanding policy of not commenting on specific investments.

He said, “I would say GIC is welcome everywhere in terms of our investment, and on our part, we make sure all our investments are in compliance with laws and regulations, and that we adopt… practices that are consistent with (the) market.”

His remarks did not deny the ownership but equally did not confirm it directly.

Lim also did not address concerns about the sophisticated network of holding companies allegedly used to obscure GIC’s position as ultimate owner of the land.

GIC reportedly did not respond to multiple requests for comment from US media outlet Bridge Michigan, which first revealed the story in early July.

In addition to Bridge Michigan’s initial inquiries, The Online Citizen (TOC) also reached out to GIC to clarify its ties to the network of entities, the rationale behind the investment, its environmental and governance policies, and whether there was any government consultation prior to such a large overseas land acquisition.

GIC did not respond to TOC’s request either.

Web of entities spans multiple jurisdictions

In July, Bridge Michigan, citing federal records obtained via the Freedom of Information Act, reported that the land controlled by GIC includes about one-sixth of Gogebic County, which borders Wisconsin.

This large-scale ownership had not previously been disclosed and only came to light after detailed filings were made by The Rohatyn Group (TRG), the investment firm currently managing the land.

Bridge Michigan noted that if TRG had filed under the standard US “three-tier” disclosure rules, GIC’s link to the land might have remained hidden.

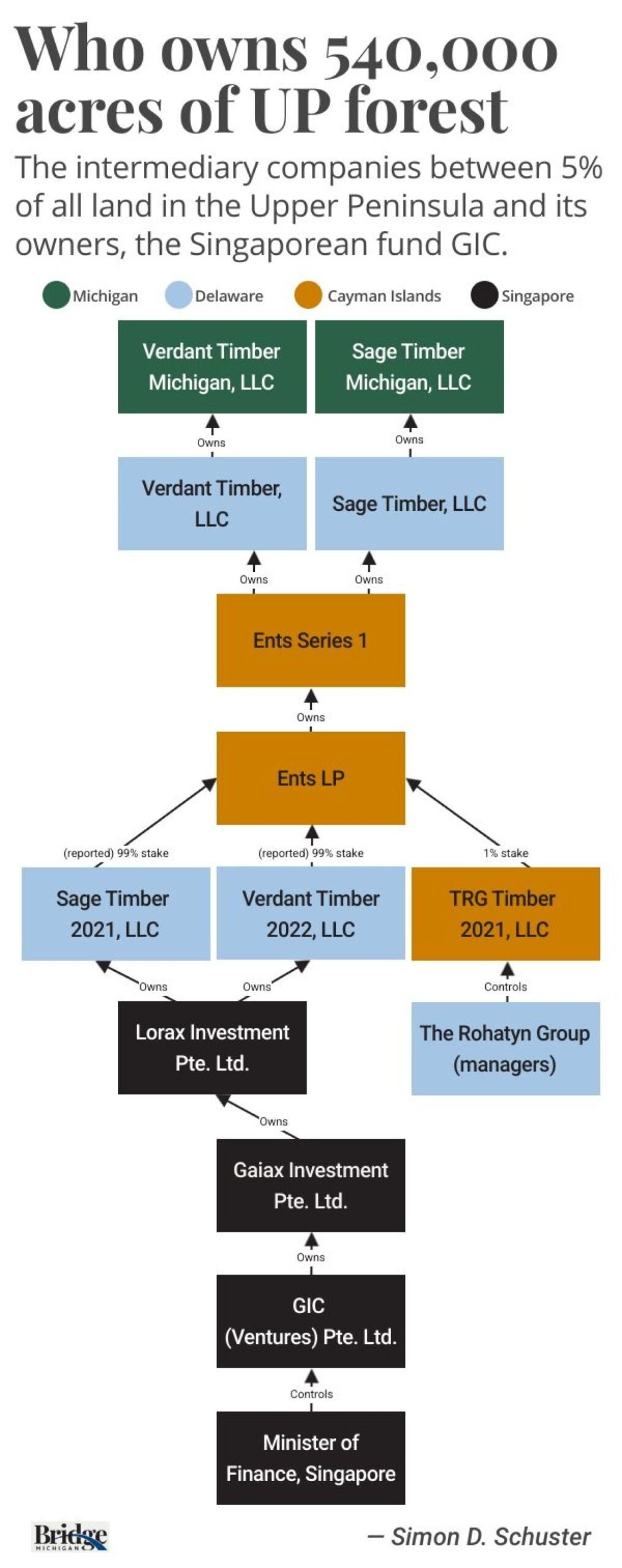

The investigation described a multi-layered corporate structure involving five Michigan-based LLCs, Delaware-registered companies, two Cayman Islands entities and Singapore-based firms.

At the top of the chain, GIC (Ventures) Pte Ltd appears as the sole shareholder, according to Bridge Michigan.

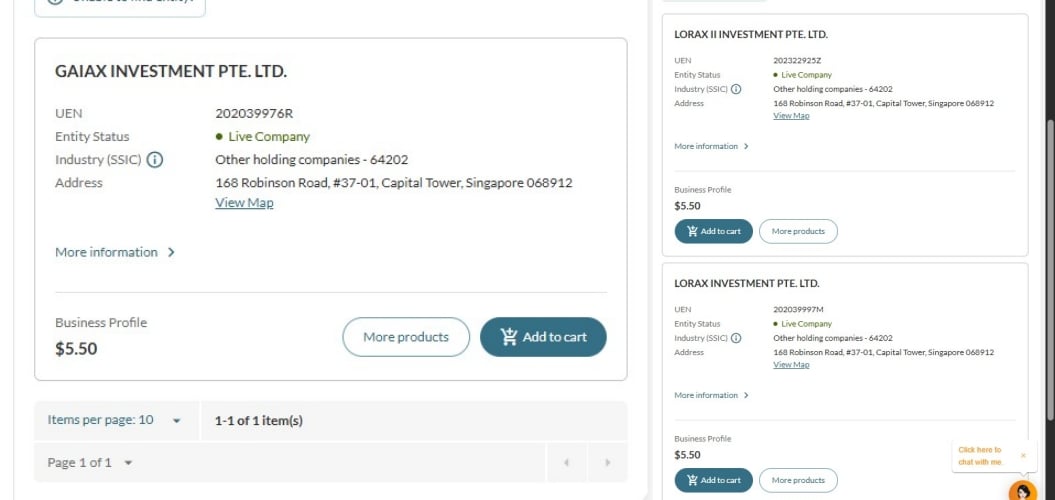

Further research by TOC found that two key Singapore entities—Lorax Investment Pte Ltd and Gaiax Investment Pte Ltd—play central roles in the structure.

Business profiles from Singapore’s Accounting and Corporate Regulatory Authority (ACRA) show that both Lorax Investment and Gaiax Investment share the same business address at Capital Tower in Singapore.

Both companies list Tammam Mouakhar and Chan Kwok Wah as directors.

Both companies list Tammam Mouakhar and Chan Kwok Wah as directors.

GIC’s own website names Tammam Mouakhar as Director of Total Portfolio Solutions, responsible for overseeing medium-term investment strategies and rebalancing.

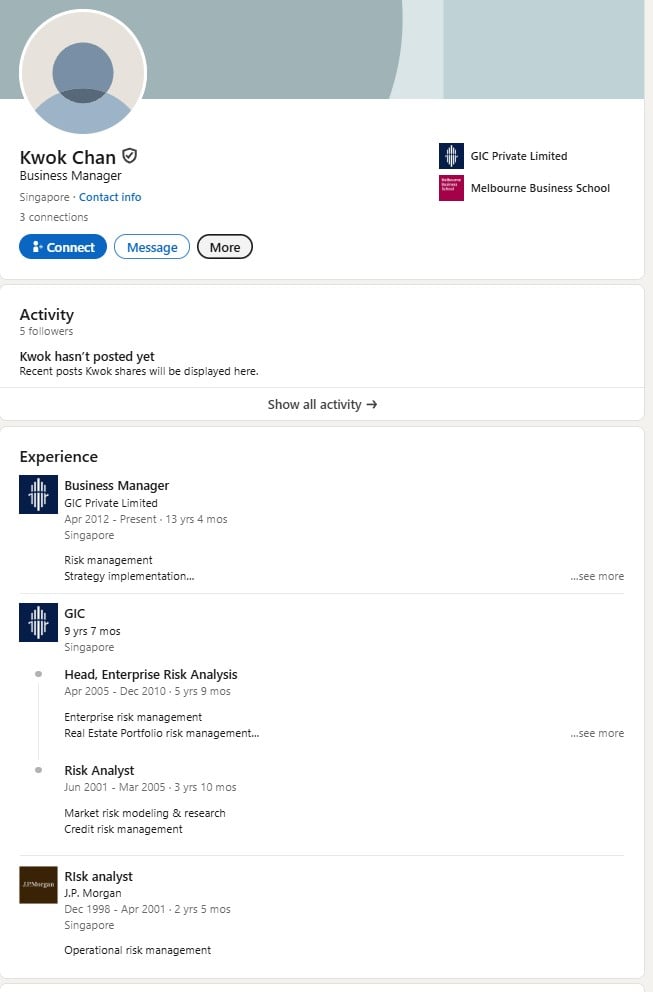

Public records and LinkedIn indicate that Chan Kwok Wah has served as a Business Manager at GIC since 2012, with responsibilities covering risk management, operations, and strategy execution.

Large-scale purchases and early gains

Bridge Michigan reported that GIC acquired the land parcels in stages, with significant acquisitions taking place between 2021 and 2022.

The purchases reportedly cost over US$450 million.

Part of the land was bought from Keweenaw Land Association in late 2021 through an all-cash transaction. However, mineral rights were retained by the seller.

In May 2022, Verdant Timber Cub LLC—linked to GIC—sold 39 acres in Keweenaw County to a private trust for US$2.4 million.

According to the report, GIC had purchased these parcels for only US$37,500, suggesting substantial early returns.

GIC’s portfolio exposure to the Americas surges to 49%

GIC’s annual report stated that the fund achieved a real rate of return of 3.8 per cent per annum for the 20 years to 31 March, 2025.

This was marginally lower by 0.1 percentage point compared with the previous year.

This figure, adjusted for inflation, is calculated over and above global inflation rates for the same 20-year period.

Without adjusting for inflation, GIC’s annualised return stood at 5.7 per cent.

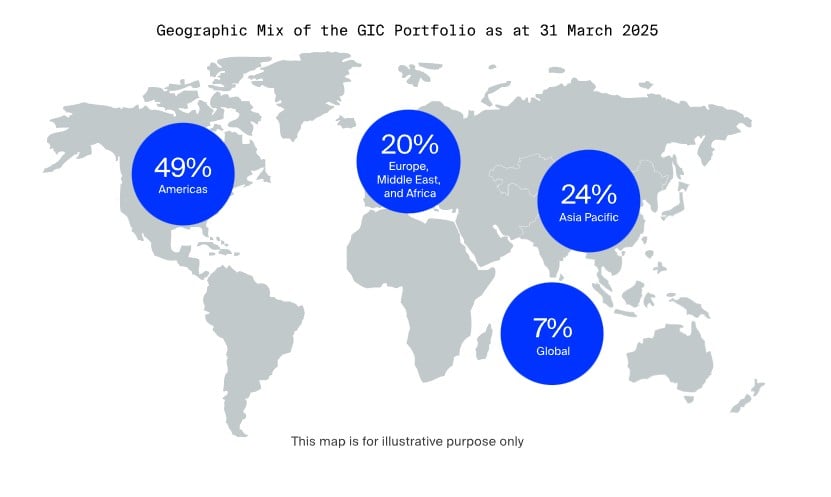

As at 31 March, 2025, GIC’s portfolio exposure to the Americas—covering North and Latin America—increased from 44 per cent to 49 per cent over 12 months.

At a briefing on 24 July, Lim said this rise was driven by appreciation of existing assets in the region and additional capital being deployed, particularly to the United States, which remains GIC’s largest investment market.

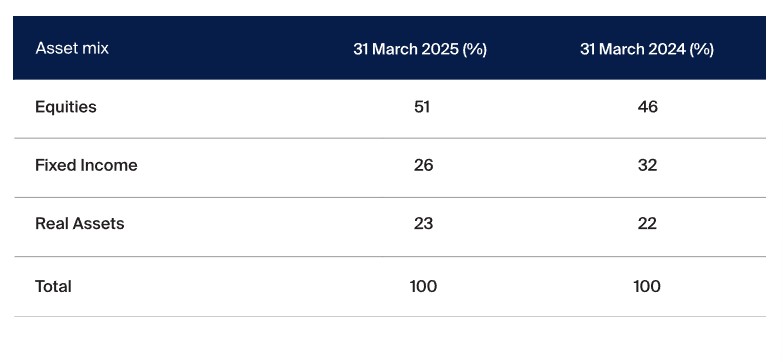

The asset mix within GIC’s portfolio also shifted.

Equities rose from 46 per cent to 51 per cent over the year.

Fixed income dropped to 26 per cent, down six percentage points. Real assets accounted for 23 per cent, a slight increase from 22 per cent the previous year.

In its report, GIC explained that its Policy Portfolio “represents GIC’s long-term asset allocation strategy, which seeks to harvest risk premia in a balanced manner that is consistent with the Client’s risk tolerance.”

On its official website, GIC describes itself as a “disciplined, long-term investor” tasked with safeguarding and growing Singapore’s financial reserves for future generations.

The fund is chaired by former prime minister Lee Hsien Loong, with current prime minister Lawrence Wong serving as deputy chairman.

The post GIC CEO declined to comment on 540K acres land ownership in Michigan, citing GIC’s longstanding policy appeared first on The Online Citizen.