SINGAPORE: At a doorstop interview during the People’s Action Party (PAP) Nee Soon GRC manifesto launch on 24 April 2025, Law and Home Affairs Minister K Shanmugam asserted that the majority of Singaporean households would not feel the effects of the recent Goods and Services Tax (GST) increase.

He backed up Prime Minister Lawrence Wong’s earlier claims, stating that government-issued support measures would more than offset any increase in GST expenditure for most families.

GST designed to tax top earners more, says minister

Shanmugam explained the tax system’s structure as one designed to collect more from high-income earners while redistributing benefits across the population.

“The GST is primarily paid by the top 20 per cent,” he said, noting that a family living in a typical three- or four-room flat would receive thousands in support through cash payouts and vouchers.

He added, “If someone pays S$100 at a restaurant, they contribute S$9 in GST. If another pays S$10 at a hawker centre, that’s only 90 cents. The larger contribution is redistributed to those paying less.”

RDU proposes GST rollback, citing cost-of-living concerns

Shanmugam’s comments were made in response to a proposal by opposition party Red Dot United (RDU), which plans to revert the GST from 9 per cent back to 7 per cent.

RDU’s manifesto, launched the previous weekend, prioritises cost-of-living concerns through wage fairness and a “citizens-first” hiring policy.

Its secretary-general, Ravi Philemon, said that reducing GST would put more money in people’s pockets.

Other alternative parties, including the Workers’ Party and the Progress Singapore Party, have also taken aim at the GST, calling for exemptions or rollbacks in their election manifestos.

Minister criticises “partial accuracy” in opposition’s messaging

Shanmugam argued that critics often fail to convey the full picture of the GST system’s redistribution model.

“I wish the opposition would make that clear, too. It’s important, rather than saying things that are only partially accurate,” he stated.

He added that the support packages would continue to buffer households against GST-related costs for at least the next five years.

The minister also touched on inflation, stating that global issues such as the war in Ukraine have driven up prices. Ukraine and Russia are key grain producers, affecting worldwide food costs.

“Cost of living is a real issue,” he acknowledged. “That’s why the government has introduced measures such as cash support and CDC vouchers.”

He reiterated that the government is actively monitoring the situation and remains prepared to roll out more aid if necessary.

Many netizens dispute minister’s reassurances

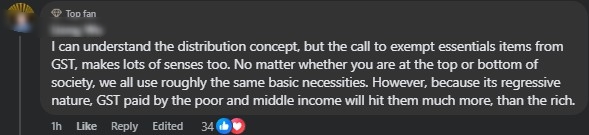

Comments collected from state media’s social media platforms reveal widespread scepticism from the public, particularly among lower- and middle-income Singaporeans.

One commonly cited concern is that GST, by its nature, disproportionately affects the less affluent.

As one comment wrote, “We all use roughly the same basic necessities. But GST hits the poor harder than the rich.”

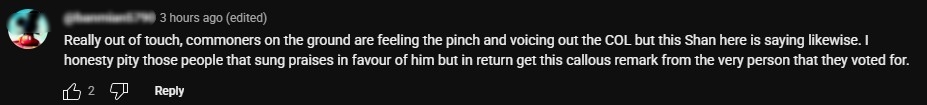

Others questioned whether ministers understood the daily financial pressures faced by ordinary citizens.

“Commoners are feeling the pinch. But Shanmugam seems disconnected,” a commenter posted.

Call for essential items to be GST-exempt

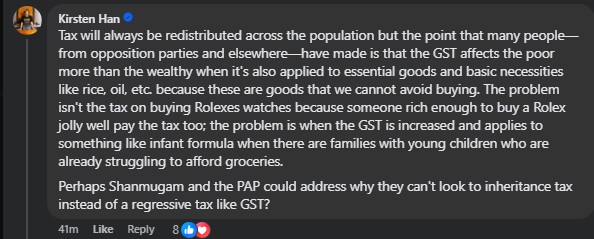

A recurring suggestion was to exempt essential goods from GST, such as rice, cooking oil, and infant formula.

Critics argue that these are unavoidable purchases, and taxing them only exacerbates inequalities.

Journalist and activist Kirsten Han weighed in, stating, “It’s not about luxury items like Rolex watches. It’s about basic goods that struggling families need to survive.”

She also questioned why alternatives like inheritance taxes were not considered in lieu of raising GST.

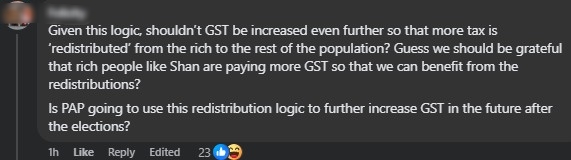

Scepticism about redistribution claims and transparency

Several users challenged the logic behind the redistribution explanation, with one stating, “Don’t just say it’s redistributed – show us how. Be transparent about the actual GST collected.”

Another added, “The government decides GST policy. Telling others to explain it first is like the kettle calling the pot black.”

Many netizens shared anecdotal evidence of rising prices, especially in food.

One mentioned a roasted chicken leg that had increased from S$4.00 to S$5.90 in under two years.

Others pointed out that hawkers do not adjust prices by one cent for every GST change, often rounding up to the nearest 10 cents, effectively resulting in steeper price hikes than the stated GST increase.

“If a family spends S$5,000 a year, even a 2% hike becomes S$100 more,” one wrote. “But actual prices jump more than that because of rounding and inflation.”

One-off payouts seen as inadequate against daily expenses

While acknowledging the annual cash support and GST vouchers, many said they were insufficient.

“Getting S$800 back once a year doesn’t make up for the daily increases in food, transport, and essentials,” one netizen posted.

Some even expressed disillusionment, lamenting the perceived lack of empathy from leaders.

“Listen to the people. You’re the government – you can adjust GST if you want to,” wrote another.

The post GE2025: Shanmugam echoes PM Wong’s claim that most households won’t feel impact of GST hike appeared first on The Online Citizen.