Independent investigative outlet Whale Hunting has alleged that former Thai Prime Minister Thaksin Shinawatra built a shadow empire valued at between US$2.5 billion and US$3.5 billion through African mining interests, Cambodian casinos, and offshore companies.

At the centre of these dealings, according to the investigation, is South African-born fixer Benjamin Mauerberger, a convicted fraudster with a two-decade history of scams.

Whale Hunting reported that Mauerberger was responsible for major acquisitions, including the purchase of a US$60 million private jet.

The newsletter and podcast platform, part of Project Brazen, is hosted by Tom Wright and Bradley Hope, former Wall Street Journal reporters who led the landmark investigation into the 1MDB scandal.

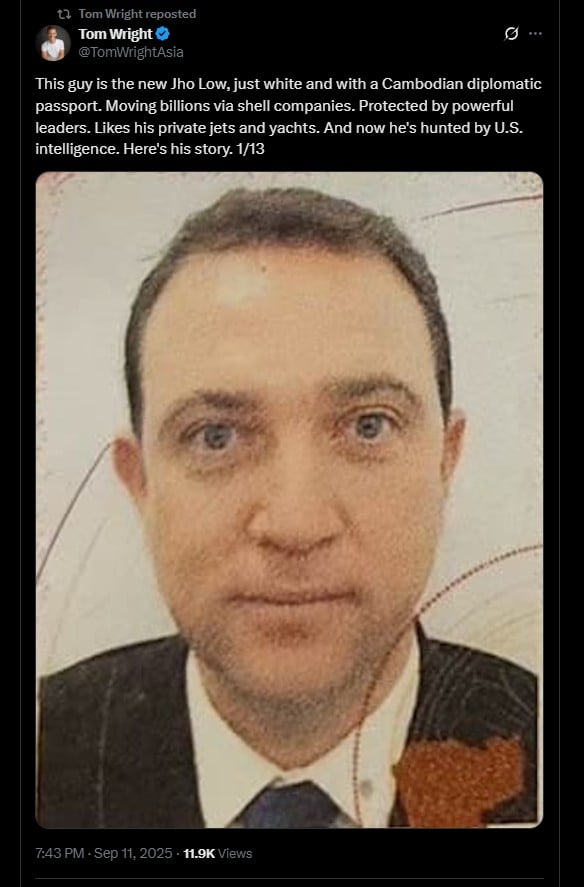

In a post on X (formerly Twitter), Wright described Mauerberger as “the new Jho Low” — a fixer with a Cambodian diplomatic passport, moving billions through shell companies, shielded by powerful leaders, indulging in private jets and yachts, and now pursued by U.S. intelligence.

A fixer at the heart of transnational finance

Whale Hunting’s report has detailed how Mauerberger, together with his wife Cattaliya Beevor, operated Singapore-based funds and Thai shell companies to channel Cambodian money into Thailand’s economy.

The pair’s network is alleged to have deep ties to Cambodia’s ruling elite, specifically the Hun Sen dynasty.

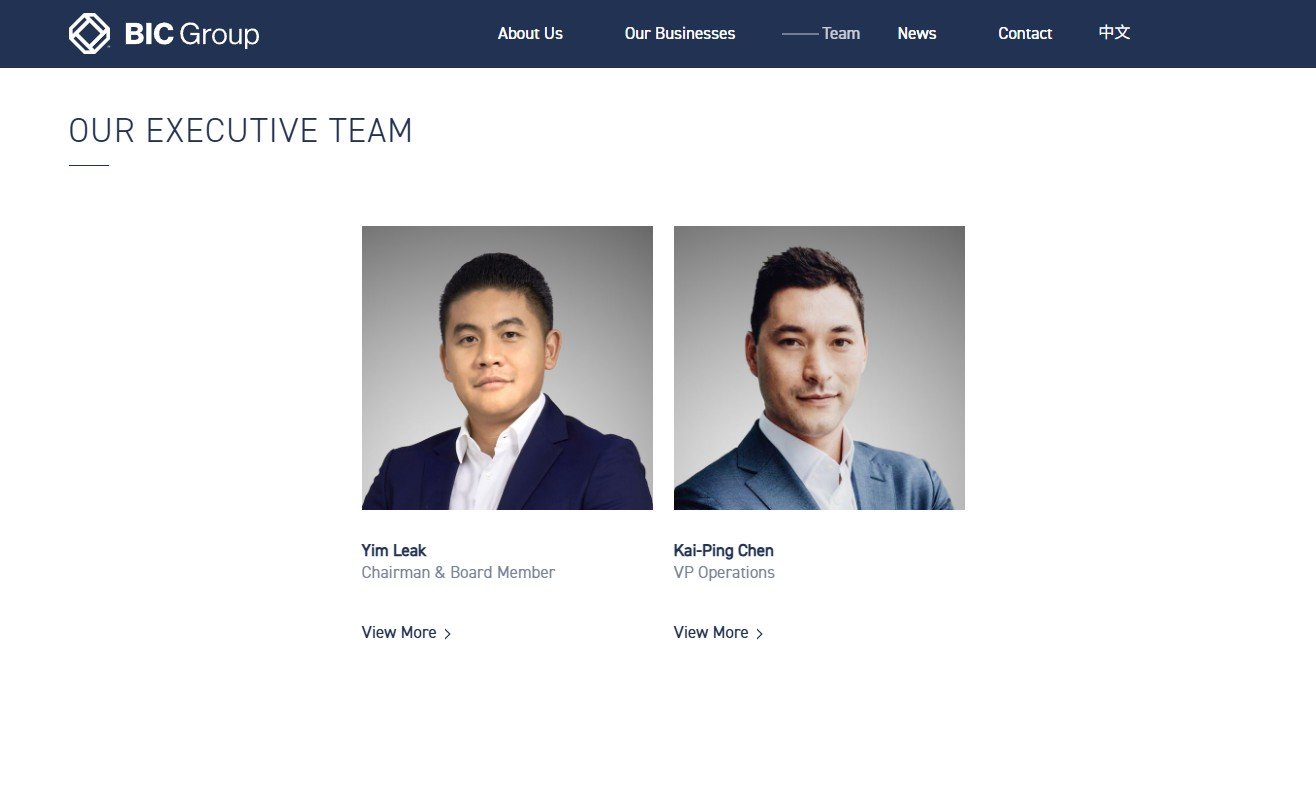

Investigators have linked Mauerberger to Yim Leak, a Cambodian tycoon whose sister is married to Hun Sen’s son, Hun Many.

Sources suggest Mauerberger is a “silent partner” in Yim Leak’s businesses.

The push into Thai energy

Through these links, Cambodian-backed money has flowed into Thailand’s corporate sector.

Whale Hunting’s investigation found that the network had quietly acquired large stakes in prominent Thai firms.

The most significant move has been into Bangchak Corporation, the country’s second-largest energy company.

By March this year, Mauerberger-linked companies, fronted through Singapore’s Capital Asia Investments (CAI) and a newly created Thai entity named Alpha Chartered, secured a 20% stake in Bangchak.

The Thai state, through its investment fund and Social Security Office, retains a 35% holding, positioning the two blocs as competing centres of influence.

Cambodia connection and political fallout

The revelations arrive amid heightened tensions between Thailand and Cambodia.

Earlier this year, border clashes killed over 40 people, primarily civilians.

In the aftermath, Thai Prime Minister Paetongtarn Shinawatra, Thaksin’s daughter, was ousted by the Constitutional Court after outrage over a leaked phone call with Hun Sen.

The phone call controversy underscored the sensitivity of Thaksin’s long-standing ties to Cambodia.

During his years in exile, Hun Sen had offered him refuge and even an economic advisory role.

Investigators now suggest these connections may have facilitated the financial flows underpinning the Bangchak stake.

Anatomy of the front companies

At the heart of the network is Capital Asia Investments, founded in Singapore in 2017.

CAI rapidly built a 14% stake in Bangchak before offloading part of it to Alpha Chartered.

Alpha Chartered’s paper trail reportedly links back to Cattaliya Beevor.

Its parent company previously shared an office address with Apex Equity Ventures, the firm used to purchase a US$20.3 million penthouse at the Aman New York Residences.

Records also show Beevor directly managing CAI’s ventures with its Singaporean CEO Eugene Tang.

Investigators allege that Beevor acts as a “cutout” for Mauerberger, ensuring his name remains absent from formal documentation.

His ex-wife, Suparat Sangamuang, is said to have performed a similar role.

Beyond Bangchak: wider acquisitions

The acquisition pattern is not limited to Bangchak.

Records reveal that entities connected to CAI and Beevor also purchased large stakes in Finansia X PCL, a Thai securities firm.

Beevor acquired 9% of Finansia X last year before selling it within months.

Cambodia’s BIC Bank, founded by Yim Leak, mirrored this pattern, suggesting coordinated financial manoeuvres.

Such short-term trades have raised suspicions among analysts of market manipulation and money laundering, especially given the opaque ownership structures behind the transactions.

A long history of fraud and flight

Mauerberger’s role as fixer dates back decades.

Born in Cape Town, he first came to prominence in Bangkok’s “boiler room” scams of the late 1990s, selling worthless stocks to overseas investors.

He has since been convicted in New Zealand and accused in Thailand of unauthorised securities trading.

Despite these convictions, Mauerberger cultivated ties with elites in Cambodia and Thailand.

In Cambodia, he secured land deals and casino projects, reportedly taking a cut of money laundering operations run through gambling venues.

Sources state that by the late 2010s, the network was handling as much as US$1 billion annually.

In return, Mauerberger is said to have received a Cambodian diplomatic passport and an advisory post to the Senate.

U.S. authorities watching closely

The United States has reportedly taken an interest in Mauerberger’s activities.

According to Whale Hunting, his network has been identified as a financial conduit for both political dynasties and foreign powers.

U.S. authorities have tracked his assets and are monitoring links between Cambodian laundering operations and Chinese organised crime groups.

Washington fears that the same dynamics that drew Cambodia into China’s orbit could destabilise Thailand if left unchecked.

Energy, politics, and the future

The timing of the Bangchak acquisitions has raised further concerns.

Thailand’s government had recently revived talks with Cambodia over disputed oil and gas fields in the Gulf of Thailand.

Any agreement could boost Bangchak’s upstream energy ventures, directly benefiting shareholders including Alpha Chartered.

However, not all in Thailand’s elite welcomed the developments. Sarath Ratanavadi, founder of Gulf Energy and a long-time ally of Thaksin, is reported to have opposed the moves, particularly as they threatened his liquefied natural gas business.

His break with Thaksin is considered a factor in the political turbulence that followed.

Whereabouts uncertain

Following recent reports, Mauerberger’s visibility in Bangkok has decreased.

He is believed to be in Dubai or Cambodia. His luxury yacht “Wanderlust” was last spotted near Turkey, in waters where Russian oligarchs also anchor their vessels.

Yim Leak, meanwhile, has withdrawn from public view, deleting his social media accounts.

His firm, BIC Group, recently altered its website, removing Thai police and finance figures previously listed as advisers.

Thailand’s Supreme Court ruled on 9 September that Thaksin must serve a one-year prison sentence, revisiting his 2023 conviction for fraud and abuse of power.

Judges determined that his stay in a police hospital suite could not be counted as time served.

After the verdict, Thaksin entered a prison van, later posting on Facebook that he accepted the decision and expressed gratitude for the royal pardon that reduced his sentence from eight years to one.

The post Ex-Thai PM Thaksin’s fixer allegedly linked to Cambodian money network buying into Thai energy sector appeared first on The Online Citizen.