DBS announced that its banking services, including mobile banking, ATMs, and NETS, were restored following an overnight disruption on 8 March 2025.

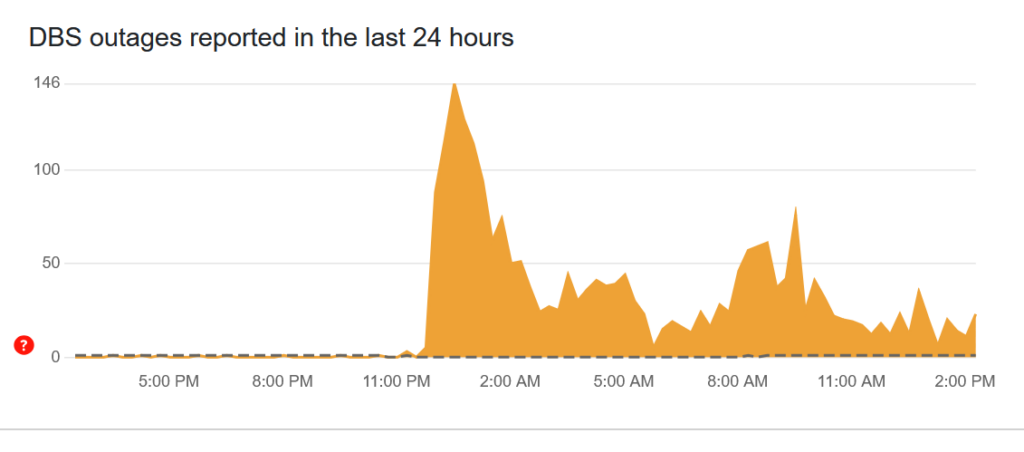

The outage, which began after midnight, prompted a surge of complaints on outage tracking site Downdetector, with reports continuing past 9 am.

At around 2.30 am, DBS acknowledged the issue in a Facebook post, stating that customers could still make payments using DBS or POSB debit and credit cards and conduct transactions at ATMs.

The bank later updated that banking services would not be available until 5 am.

At about 3.50 am, DBS reassured customers that it was working to resolve the issue and reiterated that card payments were still functional. By 5.48 am, the bank announced that all services, including mobile and online banking, digital wallet PayLah!, DBS mTrading, and ATMs, had returned to normal.

“We appreciate our customers’ patience and are sorry for the inconvenience caused,” the bank said on Facebook.

In response to CNA’s inquiries, a DBS spokesperson confirmed that all services had resumed as of 5.48 am on 8 March 2025. The bank added that it was investigating the cause of the disruption.

“Our monitoring systems detected that our customers faced difficulties accessing our banking services, including ATMs and NETS. Our teams immediately worked to resolve the issue with utmost priority,” said the spokesperson.

Despite the announcement, some users continued to report issues.

According to Downdetector, complaints continued to be registered even after DBS reported full-service restoration, with the majority reporting having issues with their mobile app.

This latest disruption follows a series of outages in 2023 that led to regulatory action from the Monetary Authority of Singapore (MAS).

The MAS barred DBS from acquiring new business ventures for six months and required the bank to pause non-essential IT changes while maintaining its branch and ATM networks in Singapore.

To address these recurring issues, DBS allocated a special budget of S$80 million in November 2023 to enhance its technology infrastructure and system resiliency.

Additionally, the bank’s senior management, including CEO Piyush Gupta, faced cuts to their variable pay in response to the 2023 disruptions.

Despite the pay reduction, Gupta’s total compensation rebounded to S$17.6 million in 2024, reflecting a 14.3% increase from 2022, as DBS posted record profits and strong shareholder returns.

The bank reported robust financial performance despite regulatory scrutiny, reinforcing its position as Singapore’s largest lender.

DBS is now under renewed scrutiny as it investigates the cause of this latest service outage.

The post DBS services restored after overnight disruption, bank investigating cause appeared first on The Online Citizen.