Associate Professor Jamus Lim of the Workers’ Party has weighed in on the ongoing debate regarding the impact of the Goods and Services Tax (GST) hike on inflation, offering a nuanced macroeconomic perspective that challenges both government narratives and opposition rhetoric.

In a Facebook post on Sunday (2 Mar), Assoc Prof Lim outlined why the macroeconomic effects of tax changes are more complex than simple one-for-one translations into price increases.

He pointed out that while microeconomic theory suggests that supply and demand responsiveness would usually prevent a direct 1:1 pass-through of tax hikes to prices, other macroeconomic factors could amplify or dampen inflationary effects.

A Complex Economic Landscape

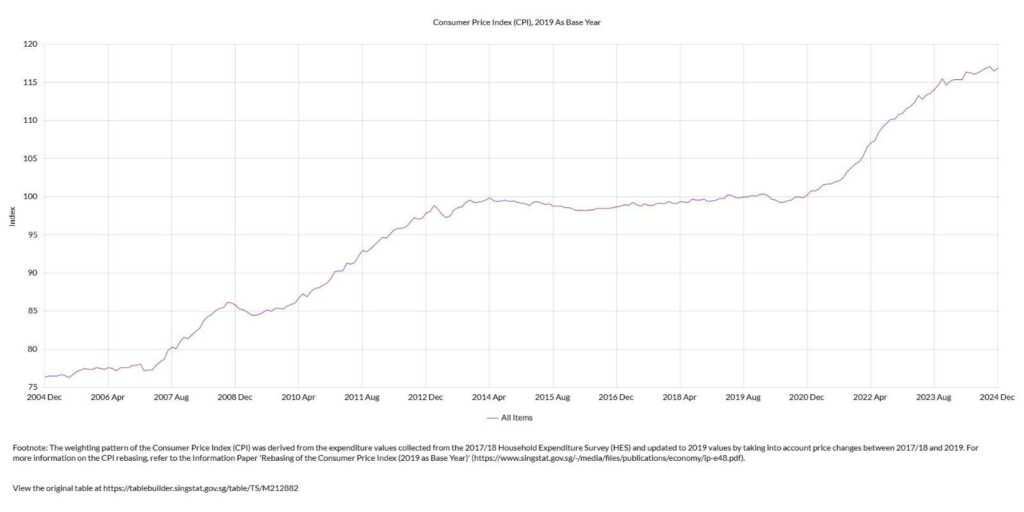

Assoc Prof Lim noted that Singapore’s government raised GST in two consecutive years, at the start of 2023 and 2024, and that his initial concerns about potential inflationary effects were drawn from global experiences, particularly Japan.

While some had dismissed the idea that GST hikes significantly contribute to inflation, the associate professor of economics at ESSEC Business School emphasized that the reality is far more intricate.

“The ultimate impact will depend on the responsiveness of supply and demand to price changes. So, it’s natural to exp ect a less than 1:1 effect, since the slopes of supply and demand curves are seldom vertical (or inelastic),” he explained.

He added that the Monetary Authority of Singapore (MAS) estimated that GST hikes contributed around 1 percentage point to inflation.

This means that GST accounted for approximately 20% of inflation in 2024 (when overall inflation was 4.8%) and 40% in 2023 (when inflation was 2.4%).

More Than Just a Tax Hike

However, Assoc Prof Lim stressed that businesses do not always increase prices in a linear manner.

Some take the opportunity of a tax hicke to adjust long-stagnant prices, meaning price hikes could exceed the immediate tax increase.

Furthermore, broader macroeconomic dynamics—such as contractionary effects on demand and aggregate output—could either counterbalance or exacerbate inflationary pressures.

“Suppliers need not respond to a 1 percent tax increase by increasing prices by 1 percent. They could take the opportunity to alter prices that had remained fixed for a while, and choose to do so by more,” he noted.

He also pointed out that a government’s fiscal strength plays a role in determining the multiplier effect of a tax hike.

Citing his own research from five years ago, Assoc Prof Lim explained that stronger fiscal positions tend to amplify economic multipliers.

“If a government’s fiscal position was strong, multipliers can well be larger, and vice versa,” he said, referencing his co-authored study published in the Journal of Monetary Economics.

A Misguided Policy Timing?

Assoc Prof Lim was particularly critical of the timing of the GST hike, arguing that it was unnecessary given Singapore’s fiscal position.

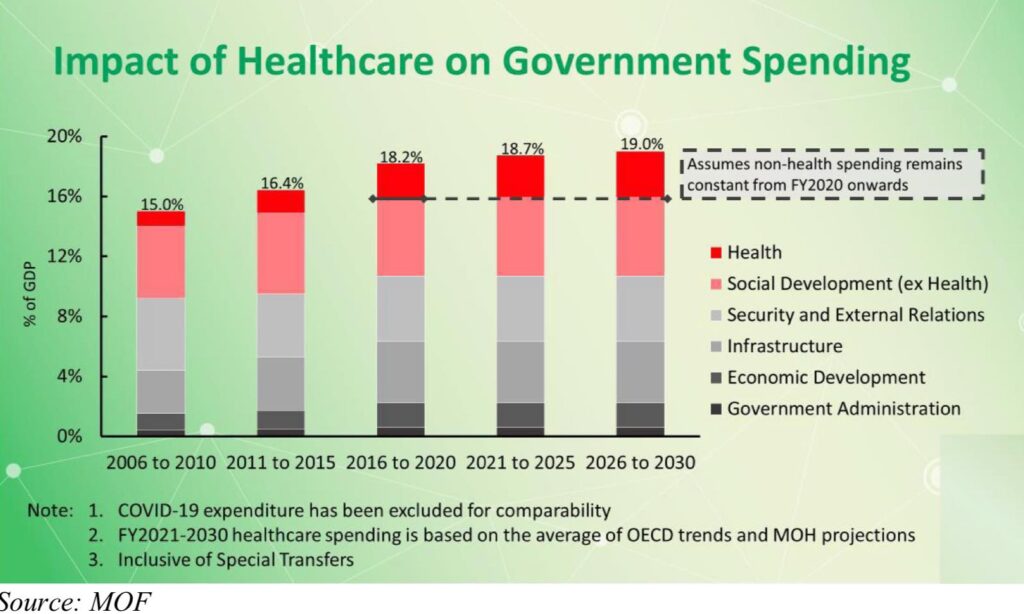

While the government justified the tax increase as a measure to finance rising healthcare costs for an aging population, he pointed out that these expenses would only significantly increase from 2026 onward.

In contrast, Singapore had enjoyed extraordinarily high corporate tax receipts in 2022 and 2023, which should have been sufficient to delay the GST hike.

“What matters is that we want to limit any contribution to inflation, at a time when prices are already rising fast. That’s why I had felt, even if we die-die needed to raise the money via GST rather than some other way, the hike couldn’t have been more ill-timed. It could have waited till inflation wasn’t as pressing, and when the consumer was hurting less,” he argued.

His remarks directly challenge Prime Minister Lawrence Wong’s assertion that the inflationary impact of GST would have been lower had inflation been higher overall. Assoc Prof Lim countered that the key concern should have been avoiding additional inflationary pressure rather than justifying its relative scale.

The Turbocharging Debate

Pritam Singh, Leader of the Opposition, had previously argued in Parliament that the GST hike had “turbocharged” inflation, which sparked an intense backlash from People’s Action Party (PAP) supporters and leaders, with Prime Minister Lawrence Wong himself refuting the claim while sidestepping Singh’s point about the Monetary Authority of Singapore’s own data.

While Assoc Prof Lim acknowledged that the phrase was open to interpretation, he left it to the public to judge whether a 20% or 40% contribution to inflation constituted turbocharging.

“Just by the numbers alone, 1 percent of last year’s 4.8 percent inflation is around 20 percent. The year before, the proportion was 40 percent. I’ll let folks decide for themselves if this contribution to inflation was significant,” he said, injecting a dose of wry skepticism.

Ultimately, Assoc Prof Lim concluded that while GST vouchers offset some of the costs for households, the entire process of raising taxes in an inflationary period only to later rebate a portion of it through handouts seemed unnecessarily convoluted. “The entire rigmarole just seemed so… unnecessary,” he remarked.

His comments add yet another layer to the already heated debate surrounding Singapore’s fiscal policy, reinforcing questions about whether the timing of the GST hike was in the best interests of Singaporean households.

The post Assoc Prof Jamus Lim criticizes timing of GST hike, highlights inflationary impact appeared first on The Online Citizen.