SINGAPORE: The High Court has dismissed a wrongful termination lawsuit filed by a former Prudential agency leader who claimed he was dismissed for whistleblowing on alleged regulatory breaches within the insurer.

See Jen Sen, who worked with Prudential Assurance Company Singapore for 19 years, had his agency agreement terminated in March 2022.

He later alleged that Prudential acted against him after he reported what he believed were regulatory breaches to the Monetary Authority of Singapore (MAS).

In a written judgment issued on Monday (10 Nov), Justice Choo Han Teck rejected all of See’s claims, including wrongful termination, unjust enrichment, and a breach of the Unfair Contract Terms Act.

The court also dismissed Prudential’s counterclaim that he had caused the company loss by breaching clauses in his agency agreement.

See was represented by Ragbir Singh Ram Singh Bajwa of Bajwa & Co and Gan Teng Wei of Castle Law. Prudential was represented by Terence Seah and Joavan Christopher Pereira from JWS Asia Law.

Background to the Dispute

During his time at Prudential, See held roles including agent, associate manager, and agency leader.

In October 2020, while serving as a financial services director, he discovered that Prudential representatives and other parties had posted life insurance advertisements on social media, which he believed contravened MAS advertising guidelines.

He reported the matter to Prudential’s compliance team and wrote directly to the then-chief executive officer. Internal investigations were conducted over three months but, according to Justice Choo, made no meaningful progress.

After he submitted further proposals in January 2021, he received no further replies.

Between May and October 2021, See escalated the matter by writing to MAS on 13 occasions using the pseudonym “Patrick Goh”.

In November 2021, Prudential informed him that it was aware of the complaints lodged under that name, after which he attended a meeting with senior compliance, distribution, and legal officers.

Prudential terminated his agency agreement on 7 March 2022, giving him 14 days’ notice, as allowed under the contract.

See later sued Prudential, alleging retaliation for whistleblowing. He also sought shares and cash rewards under the Agency Leaders Long-Term Incentives Scheme (ALLTIS), and argued that Prudential had unjustly enriched itself by rejecting his application for the company’s sell-out/retirement scheme.

Prudential denied any wrongdoing and maintained that the termination was contractually valid.

It argued that See was not entitled to ALLTIS payments or the sell-out scheme, as he no longer had a valid agency agreement when payments were due and had not submitted a proper application.

The insurer further counterclaimed that he had breached the agreement by bypassing internal reporting channels.

Court: Termination Was Within Contractual Rights

Justice Choo found no basis for the claim of wrongful termination. See had argued that an implied term of “good faith, mutual trust, confidence and goodwill” restricted Prudential’s power to terminate the agreement.

However, the judge ruled that the agreement expressly allowed either party to terminate with 14 days’ written notice, and that implied terms could not override explicit contractual clauses.

“It is settled law that implied terms… do not apply when there are express termination clauses to the contrary,” he wrote.

As a result, the claims for ALLTIS payments and benefits under the sell-out scheme failed.

Justice Choo noted that although See had sent two emails about the sell-out scheme in March 2022, they did not contain the mandatory information required for a valid application.

His unjust enrichment claim was also dismissed.

Prudential’s Counterclaim Rejected

The judge likewise rejected Prudential’s counterclaim that See had breached the agency agreement by bypassing internal channels.

Justice Choo noted that See had initially reported the matter to the compliance team and later escalated it to the CEO due to its urgency. The CEO acknowledged the escalation and referred it for internal investigation.

“In my view, this was an acknowledgement by the CEO on the urgency of the matter, and therefore an acceptance that the claimant had reached out to him directly,” the judge wrote.

The court further found that See’s reports to MAS did not breach the agreement, as they were made only after internal efforts failed to produce results.

While approaching MAS might have risked Prudential’s reputation, the judge held that this had to be balanced against public interest.

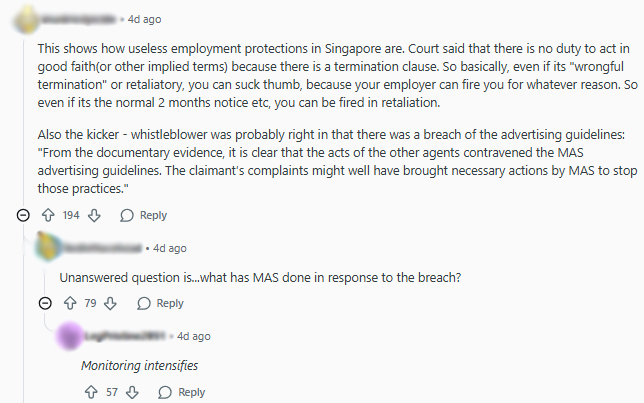

He also noted documentary evidence showing that Prudential’s CEO recognised the need for a proper framework governing social media use, and that the actions of the other agents appeared to contravene MAS guidelines.

Concern Over Lack of Protection for Whistleblowers

Following media coverage of the ruling, many netizens on platforms such as Reddit and CNA’s Facebook page expressed concern that the case highlighted gaps in whistleblower protection in Singapore.

One user questioned whether anyone would still “dare to stand up to voice out” on governance lapses after witnessing what happened to See.

A user commented that the case shows how limited employment protections in Singapore are, noting that courts will not imply a duty to act in good faith if a termination clause exists.

“So basically, even if it’s wrongful termination or retaliatory, you can suck thumb, because your employer can fire you for whatever reason,” the user wrote.

Another added: “Let this be a lesson to everyone — it does not pay to whistleblow in Singapore. Best to keep quiet even if your company is conducting illegal activities.”

Questions over how Prudential Identified “Patrick Goh”

Some netizens also questioned how Prudential identified that See was behind the “Patrick Goh” pseudonym used in complaints to MAS.

“Can’t be MAS give all the details to Prudential, right? Isn’t it supposed to be anonymous?” one user asked.

A user said she had assumed MAS would conduct its own investigation “without putting the whistleblower at risk”.

Calls for Stronger Whistleblower Safeguards

Other commenters called for reforms, with one user saying it was “time for the Ministry of Finance to implement proper whistleblower protection”.

The user noted that Singapore still lacks dedicated escalation channels for raising concerns to MAS when financial institutions “play dumb” with internal whistleblowing processes.

The post Netizens raise concerns over whistleblower protection after court dismisses suit by ex-Prudential leader appeared first on The Online Citizen.