SINGAPORE: Netizens have pushed back against Prime Minister Lawrence Wong’s claim that the Goods and Services Tax (GST) hike did not fuel inflation, arguing that it has directly contributed to rising living costs.

Speaking in Parliament on 28 February during the Budget debate, Wong rejected Opposition Leader Pritam Singh’s claim that the GST hike had “turbocharged” inflation, asserting that external factors, such as global supply chain disruptions and rising energy costs, were the main drivers of price increases.

He cited the Monetary Authority of Singapore’s (MAS) assessment that the GST hike’s impact on inflation was “transitory”, noting that the tax rate had increased from 7 per cent to 9 per cent in two stages in 2023 and 2024.

Wong pointed to the Consumer Price Index (CPI), which showed inflation falling from 6.1 per cent in 2022 to 4.8 per cent in 2023, and 2.4 per cent in 2024—even after the tax hike.

“Where is the turbocharging?” he asked.

“Look, I know elections are approaching, but this chamber is not an election rally. Let’s not get carried away by hyperbole and have a debate based on facts,” he said.

Singh countered with the government’s own estimates, which indicated that the GST hike contributed slightly less than one percentage point to core inflation.

He referred to a previous government reply stating that MAS projected 2024 core inflation to range between 2.5 per cent and 3.5 per cent, with the GST hike accounting for nearly 40 per cent of the lower-end estimate.

“That’s how I read it, hence my characterisation of ‘turbocharged’,” Singh explained.

Wong rejected this reasoning, reiterating that MAS had stated the GST hike’s impact on inflation was “once-off”.

He also argued that if the proportionate impact of the GST was larger when inflation was low, then logically, a GST hike should be introduced during high inflation periods instead.

“If the Workers’ Party really believes this, then there should be no concern about the timing of the GST increase,” he said.

GST Hike Necessary to Sustain Public Spending

Beyond the inflation debate, Wong defended the GST hike as a necessary measure to secure long-term funding for public services, stating that without the increase, Singapore would have ended the last financial year in deficit.

“Governance is about making responsible choices, not just popular ones,” he said.

To cushion the impact, Wong pointed to support measures such as the Assurance Package and GST Vouchers, designed to help lower-income groups.

However, critics argue that while these offsets are temporary, the GST increase is permanent.

Wong also dismissed opposition claims that the government’s budget estimates were overly conservative, leading to excessive revenue collection.

He insisted that Singapore’s financial projections were generally accurate and contrasted them with the debt-heavy approaches of other economies.

Rising Cost of Living

Acknowledging public concerns over rising costs, Wong assured Singaporeans that the government would continue providing cost-of-living support for as long as necessary, within fiscal limits.

However, he took aim at opposition MPs from the Workers’ Party and Progress Singapore Party (PSP), saying they appeared “unhappy” with the government’s voucher schemes.

“They suggest we rely solely on vouchers, but that’s not true. These are temporary help measures, not long-term solutions,” he said.

He emphasised that a more sustainable approach to tackling the cost of living lay in ensuring higher real incomes for Singaporeans through a strong economy and productivity gains.

“That remains the key thrust of our approach,” he said.

While Singapore has performed relatively well economically, Wong acknowledged that many Singaporeans continue to feel cost pressures in their daily lives.

To address this, he noted that the government had strengthened social support systems through Forward Singapore, ensuring that assistance is available across all life stages.

Netizens Dispute Government’s Inflation Claims

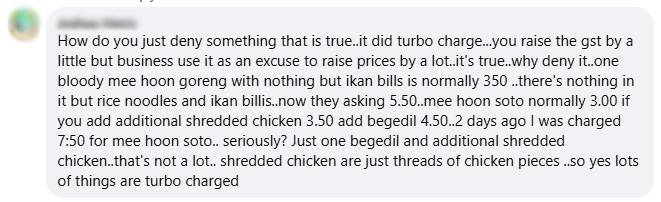

Nearly 2,000 comments across CNA, Mothership, The Straits Times Facebook, and the CNA YouTube Channel saw many netizens challenge Wong’s statement, insisting that the GST hike has impacted the cost of living.

One user questioned how the government could simply deny what was “clearly happening”, arguing that even though the GST was raised by a small percentage, businesses used it as an excuse to raise prices significantly.

Another user commented that while external factors contributed to inflation, the GST hike had worsened the situation.

They pointed out that if the increase was based on projected fiscal needs, the larger issue could be that the civil service was potentially sandbagging the budget.

One user argued that the GST increase had incrementally raised the prices of essential goods, making Singh’s “turbocharging” characterisation valid.

Another commenter stated that the GST hike was poorly timed and had led to profiteering by vendors, particularly on daily necessities.

While the government viewed the increase as only 1 per cent in 2023 and another 1 per cent in 2024, they noted that actual prices for food, groceries, and transport had surged by 20–60 per cent, with businesses citing the tax as a reason.

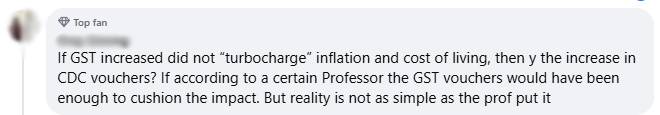

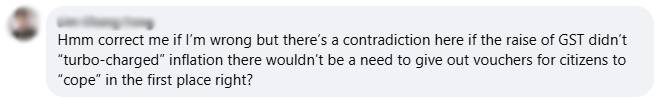

Some questioned the government’s rationale, asking why vouchers were being distributed if the GST hike had not impacted the cost of living.

One user pointed out that if the increase did not “turbocharge” inflation, there would be no need for additional CDC vouchers.

Another user called this a contradiction in the government’s claims.

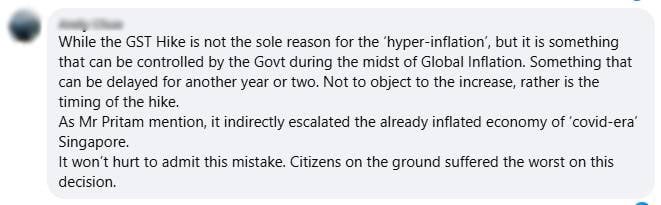

One user acknowledged that global factors played a role but argued that the GST hike was a factor the government could have controlled.

They suggested it could have been delayed instead of being implemented when Singaporeans were already struggling with post-pandemic economic challenges.

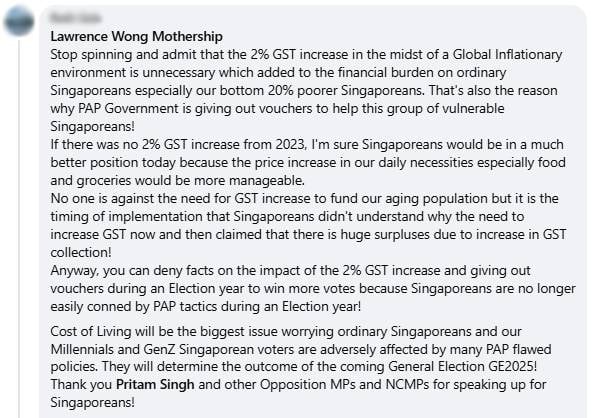

A commenter urged the government to stop “spinning” the issue and admit that the 2 per cent GST hike, implemented during global inflation, was unnecessary and had increased the financial burden on ordinary Singaporeans, particularly lower-income households.

Pritam Singh: Government data shows GST hike significantly affected inflation

Singh also took issue with Wong’s arguments, citing the government’s own data to show that the GST hike had a measurable impact on inflation.

He pointed out that the government had previously stated that the GST hike contributed slightly less than one percentage point to core inflation.

Referring to a parliamentary reply, Singh highlighted that MAS projected 2024 core inflation to range between 2.5% and 3.5%, with the GST hike accounting for nearly 40% of the lower-end estimate.

“That’s how I read it, hence my characterisation of ‘turbocharged’,” Singh explained.

Rather than addressing this specific point, Wong responded with a theoretical argument, stating that if the GST’s proportional impact on inflation was greater when inflation was low, then it would have made more sense to implement the increase during high inflation instead.

“If the Workers’ Party really believes this, then there should be no concern about the timing of the GST increase,” Wong said.

However, Singh did not argue that the GST should have been raised during high inflation to “shrink” its proportional impact. Instead, he emphasised that the tax hike had a significant and measurable effect on inflation—something the government had itself acknowledged in its projections.

Leong Mun Wai: Price hikes began before the GST increase

Progress Singapore Party (PSP) NCMP Leong Mun Wai challenged Wong’s assertion that the GST hike did not significantly contribute to inflation, arguing that price increases had already started before the tax hike even took effect.

Leong contended that businesses had preemptively raised prices in anticipation of the tax increase, leading to additional cost pressures on consumers.

He also pointed out that official inflation figures failed to capture the full extent of price hikes, particularly for cooked food and daily necessities, which many Singaporeans found to be far higher than what government statistics reflected.

Perceived Disconnect Between Government and Citizens

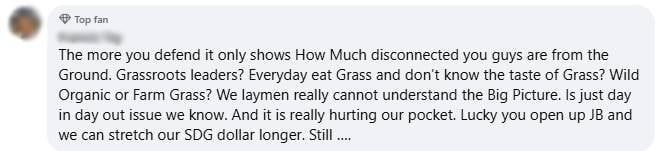

Several netizens criticised Wong’s remarks, saying they reflected a disconnect between the government and ordinary citizens.

One user remarked that the more the government defended its stance, the clearer it became that officials were out of touch with daily struggles.

They sarcastically questioned whether grassroots leaders truly understood the financial pressures of the public, comparing them to individuals who “eat grass” but cannot distinguish between different types of grass.

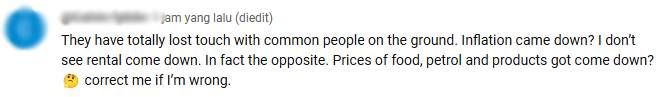

Another user argued that the government had completely lost touch with the common people, questioning how inflation could be considered under control when rental, food, petrol, and essential goods prices continued to rise.

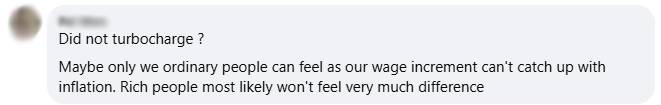

One user suggested that perhaps only ordinary people could feel the impact of inflation, as their wages had not increased at the same rate as the rising cost of living.

They noted that wealthier individuals were less likely to feel the effects, making it easier for them to dismiss concerns about whether the GST increase had “turbocharged” inflation.

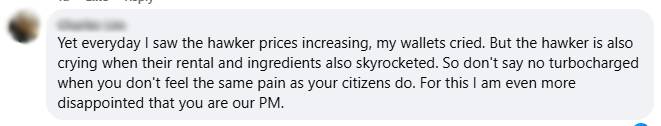

Another user pointed to soaring hawker prices, saying their wallet “cried” from the constant increases while hawkers themselves struggled with higher rental and ingredient costs.

They accused the government of being dismissive of inflation concerns because policymakers did not experience the same financial strain.

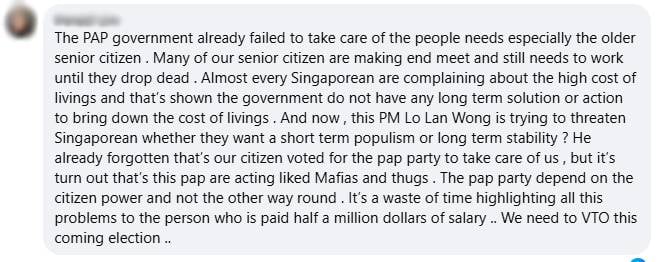

One commenter went further, claiming that the government had failed to address the needs of the people, particularly older citizens.

They noted that almost every Singaporean was complaining about the high cost of living, which they saw as proof that the government lacked a long-term solution.

The post Netizens dispute Lawrence Wong’s claim on GST and inflation, citing rising living costs appeared first on The Online Citizen.