A study conducted by the Centre for Investor Protection at the National University of Singapore (NUS) Business School, authored by Professors Mak Yuen Teen and Susan See Tho, has revealed widespread deficiencies in whistleblowing policies among companies listed on the Singapore Exchange (SGX).

While all 536 SGX-listed issuers formally disclosed having whistleblowing policies, many failed to meet key compliance requirements mandated by SGX.

According to the report, “While all issuers disclosed that they have a whistleblowing policy as required by the SGX rules, many did not provide the information or have not adopted practices that, in our view, are required to comply with the specific requirements in the SGX rules.”

The study comes as the Monetary Authority of Singapore (MAS) announced a series of equity market reforms on 21 February 2025, aimed at strengthening Singapore’s capital markets, increasing investor confidence, and promoting better corporate governance.

Major Gaps in Compliance

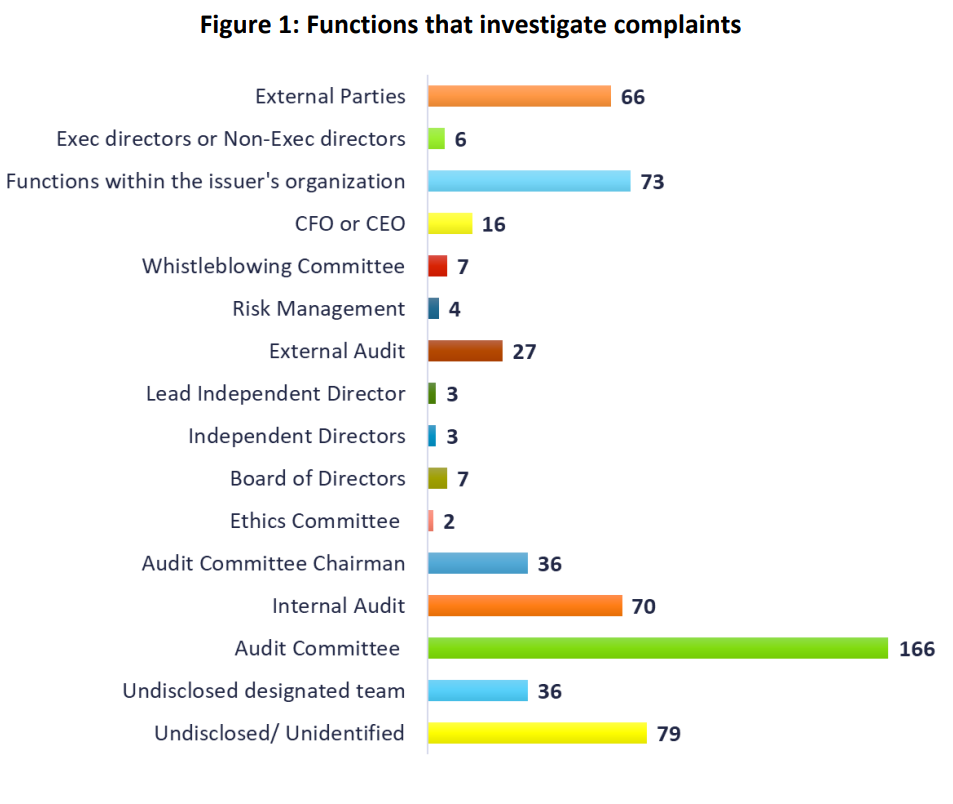

SGX rules require issuers to designate an independent function to investigate whistleblowing complaints. However, the study found that only 48.5% of companies disclosed having at least one independent function to do so. A further 23.7% of issuers did not specify who investigates complaints, and another 19.8% did not disclose how their Audit Committee (AC) oversaw whistleblowing processes.

The report stated: “Overall, we assess that only 260 of the 536 issuers covered (48.5%) have disclosed and have at least one independent function to investigate complaints and are compliant with SGX rules.”

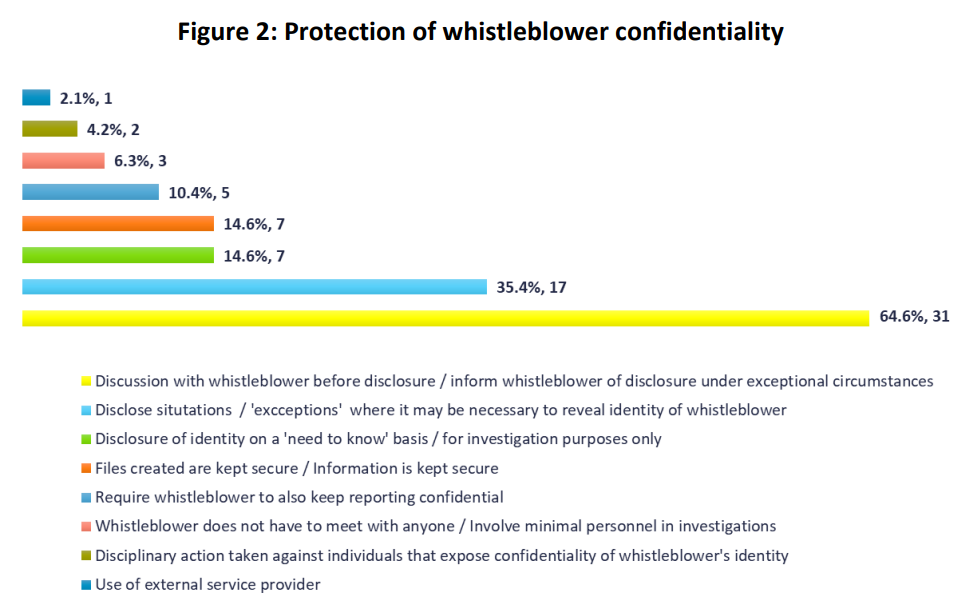

Confidentiality protections were also lacking, with only 8.8% of companies explaining how whistleblower identities would be protected. While 85.1% of issuers committed to confidentiality, they failed to disclose the measures taken.

“33 issuers (6.2%) did not disclose any information about keeping the identity of the whistleblower confidential and therefore were not compliant with the requirements. Another 456 issuers (85.1%) disclosed a commitment to do so but did not disclose how and were therefore arguably also not fully compliant,” the study noted.

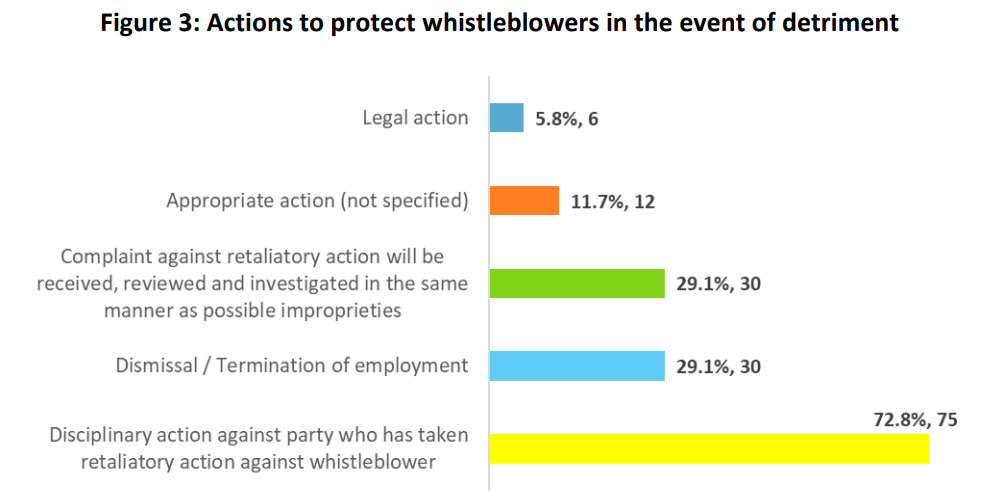

Additionally, protections against retaliation were found to be inadequate. The study revealed that 3.9% of issuers did not mention any protections against reprisals, and only four companies (0.7%) specified how whistleblowers would be supported during investigations.

“21 issuers (3.9%) did not disclose a commitment to protect whistleblowers against reprisals. While the rest disclosed a commitment to do so, only four issuers (0.7%) specifically mentioned what they will do to support and protect the whistleblower during the investigation period,” the study stated.

Limited Adoption of Best Practices

Beyond SGX compliance, the study assessed the adoption of international best practices. Only 46.3% of issuers published their whistleblowing policies online, limiting accessibility for stakeholders. Training on whistleblowing was also scarce, with only 15.5% of companies disclosing that they provided such training.

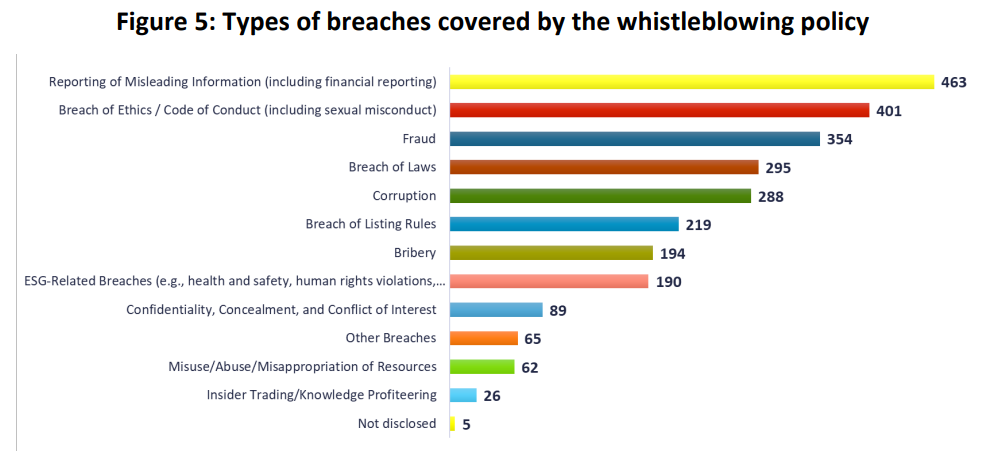

The handling of complaints also raised concerns. While 28% of issuers stated that all complaints were investigated, 31% admitted that only some were investigated, and 41% provided no disclosure on the matter. Furthermore, 5.6% of companies explicitly stated they do not accept anonymous complaints, and 43.5% were silent on the issue.

The report also pointed to potential weaknesses in whistleblowing frameworks, stating: “Issuers that have no whistleblowing complaints may simply have policies that are ineffective.”

Whistleblowing in Focus: The SingPost Case

The importance of robust whistleblowing mechanisms was underscored by the recent case involving Singapore Post (SingPost).

In December 2024, SingPost terminated its Group CEO, CFO, and another senior executive following an investigation triggered by a whistleblower complaint.

The complaint alleged that the company’s international business unit manipulated delivery status codes to avoid contractual penalties.

The case highlighted the critical role of whistleblowers in exposing corporate misconduct and raised concerns about whether SGX-listed companies have sufficient safeguards in place to protect whistleblowers and ensure independent investigations.

Corporate Governance and MAS’s Market Reforms

In response to broader corporate governance concerns, MAS announced on 21 February 2025 a comprehensive set of reforms to enhance the competitiveness and integrity of Singapore’s equities market.

The measures include a S$5 billion Equity Market Development Programme (EQDP) to boost investment in Singapore-listed equities, tax incentives for fund managers, and enhanced research and investor engagement initiatives.

Regulatory changes will also move Singapore towards a more disclosure-based regime, reducing merit-based judgments for new listings while streamlining prospectus requirements.

Additionally, SGX Regulation (SGX RegCo) will take on greater responsibility in listing reviews and post-listing oversight, while a consultation will be held on the removal of the financial “Watch-List.”

Call for Stronger Whistleblower Protections

The Centre for Investor Protection’s study found that while all companies disclosed having a whistleblowing policy, many lacked transparency or mechanisms to ensure compliance.

A 20-item whistleblowing scorecard developed by the researchers assigned companies a score out of 40, with an average score of just 20.6. Only 54.7% of issuers scored at least 20, and just 9.7% achieved a score above 30.

The study also highlighted Singapore’s fragmented approach to whistleblower protection, as existing laws such as the Prevention of Corruption Act and the Companies Act provide limited safeguards.

“The fact that there is no overarching whistleblower protection legislation in Singapore is also likely to adversely affect the effectiveness of whistleblowing policies. We believe that Singapore should consider introducing such legislation,” the authors stated.

Additionally, the report emphasised that strong corporate culture and independent oversight were necessary for effective whistleblowing policies:

“A good corporate culture provides an environment in which employees believe that they will not be victimised if they make reports in good faith and reasonable belief even if their reports turn out to be wrong. An independent and effective board ensures that all reports are taken seriously and investigated where there is sufficient basis, with appropriate actions taken.”

Looking Ahead

As MAS and SGX RegCo push for reforms to enhance Singapore’s equity markets, the findings from the whistleblowing study highlight an urgent need for stronger corporate governance measures.

Companies must move beyond minimal compliance and ensure that whistleblowing mechanisms are independent, transparent, and effective in protecting those who expose misconduct.

With further regulatory changes expected by the end of 2025, including potential enhancements to investor protection, the landscape for corporate governance in Singapore is set to evolve significantly.

Whether these changes will lead to tangible improvements in whistleblower protections remains to be seen.

The post SGX-listed companies fall short on whistleblowing compliance, study finds appeared first on The Online Citizen.