SINGAPORE: More than 230,000 students nationwide are moving towards e-payment methods when purchasing food or stationery at school canteens and bookshops.

Speed and ease of use are among the main reasons students and vendors are adopting e-payment methods, particularly during the brief 30-minute recess period.

Mr Keith Loh, 51, who operates an economy rice stall at Anderson Secondary School, highlighted the time-saving benefits of e-payments.

Since students need sufficient time to eat, he completes most of the meal service within the first 10 minutes of recess.

“Paying in cash or coins takes longer as we need to count and provide change – even if it’s just 10 or 30 seconds. But with a machine-led system, students can just scan and go,” he said.

He also noted that the payment terminal makes transactions more efficient, particularly when students customise their meals.

The adoption of e-payments in schools is part of the POSB Smart Buddy programme, a tap-and-pay initiative first introduced in 2017 across 19 primary schools.

The programme aims to familiarise children with digital payments and financial literacy.

In 2022, the Ministry of Education (MOE) and POSB signed an agreement to expand the scheme to all primary and secondary schools, junior colleges, and the Millennia Institute by 2025.

As of December 2024, more than 70 per cent of MOE schools have adopted the programme, including 80 per cent of primary and secondary schools and 15 per cent of junior colleges and the Millennia Institute.

MOE stated that some older students in junior colleges and the Millennia Institute were already using other e-payment options before the roll-out of the POSB Smart Buddy programme.

“This also fulfils our objective of providing e-payment solutions across all schools,” the ministry said in an e-mail response.

Each participating school has an average of eight payment terminals, along with two terminals for checking account balances.

Beyond the Smart Buddy smartwatch or card, students can also use school smartcards, ez-link cards, Nets FlashPay, and POSB or DBS ATM cards at the school payment terminals.

This allows them to consolidate their spending across different needs.

Students from low-income households also benefit from the system, as schools can discreetly disburse financial aid through e-payments.

Vendors Face Cash Flow Issues, Students Risk Overspending

Despite its advantages, some canteen stall vendors have raised concerns about the system.

One major issue is the delay in receiving earnings from e-payments, unlike cash transactions that provide immediate funds.

Some school canteen vendors, already operating on tight margins to keep food affordable, struggle with cash flow due to delayed payments.

Students may also be less mindful of their spending when using e-payments.

To address such concerns, POSB is conducting workshops on basic financial concepts at 100 MOE-run primary schools and pre-schools.

The initiative, launched in July 2024 as part of a national savings drive, aims to benefit between 40,000 and 50,000 students.

Netizens Worry E-Payments Will Weaken Kids’ Money Management Skills

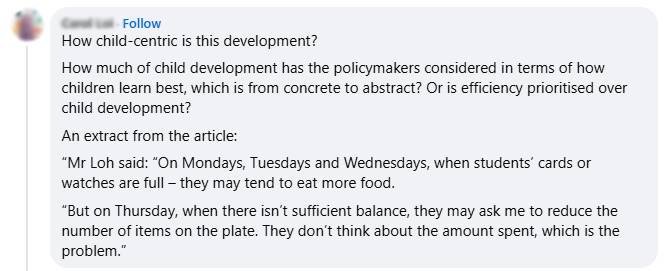

A Facebook post by The Straits Times on the implementation of e-payment in schools drew over 470 comments, with many netizens expressing disagreement.

Many argued that young children, especially those in primary school, would not learn how to count and value money.

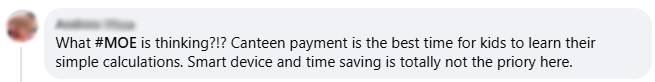

One user questioned the MOE’s decision, stating that canteen payments provide the best opportunity for children to learn simple calculations.

The user felt that smart devices and time-saving should not be the priority in this case.

Another commenter expressed concern that children would struggle with cash transactions in the future, stating that they might not know how to use cash, how much to pay, or how much change to take back.

A similar sentiment was shared by another netizen who understood the convenience of e-payments but believed that primary students need to learn to count money and perform mental calculations during transactions.

Some users felt that handling physical money is crucial for financial literacy.

One person commented that it is good for children to learn how to handle cash as it helps them understand the value of money better.

The user suggested that e-payment methods should only be introduced after primary or secondary school.

E-Payments May Impact Kids’ Spending and Financial Awareness

Others highlighted potential issues with financial discipline. One commenter pointed out that young children might frequently lose or damage their smart cards or watches.

The user also stressed that children’s understanding of money is still developing and should be based on physical transactions rather than abstract concepts.

Another netizen warned that going cashless might lead to reckless spending. The user stated that children would not appreciate the value of money when transactions are as simple as tapping a device.

They also noted that, in the long term, children’s ability to count change could weaken if they rely solely on e-payments.

One commenter also questioned whether children would develop a habit of saving money.

The user believed that the ease of making payments with a smartwatch could lead to excessive spending, as children might buy whatever they want without considering their budget.

Some users also drew similarities between children using e-payments and adults using credit cards.

One user pointed out that studies have shown even adults who pay with cash are more aware of their spending and feel the impact of their purchases.

In contrast, those who use credit cards do not experience the same level of financial awareness.

Another commenter raised concerns about how students would learn to count physical money, perform calculations, and understand the value of saving.

The user compared it to an adult using a credit card without realising they have reached their spending limit.

Government Faces Backlash Over School E-Payment System

Some users also criticised the government’s role in promoting e-payments in schools, expressing concerns about its long-term effects on financial habits.

One user urged the government to stop the initiative immediately, warning against allowing banks to influence children at such a young age.

The commenter argued that as these children grow up, they will become accustomed to making payments without handling physical cash, making spending feel less painful compared to physically counting and parting with dollar notes for purchases.

Another commenter remarked that the MOE appeared to prioritise organisational efficiency over the crucial opportunity for children to learn and understand cash management.

A different user questioned whether policymakers had truly considered child development when implementing the system.